Almond Kernels Market Size 2024-2028

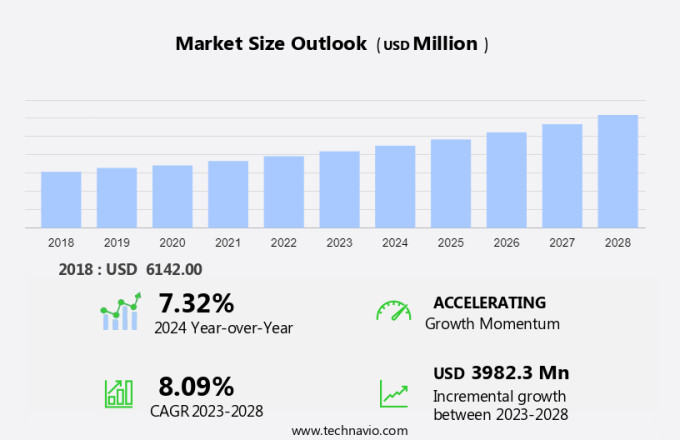

The almond kernels market size is forecast to increase by USD 3.98 billion at a CAGR of 8.09% between 2023 and 2028.

- The market is experiencing significant growth, driven by increasing consumer awareness about the health benefits associated with these nuts. Rich in protein, fiber, and healthy fats, almond kernels are a popular choice for health-conscious individuals. Additionally, the rising trend of online distribution platforms is contributing to the market growth, making almond kernels more accessible to consumers worldwide. However, stringent government regulations on supplying almond kernels, particularly in terms of quality and safety, pose challenges to market players. Ensuring compliance with these regulations can be costly and time-consuming, but failure to do so can result in penalties and damage to brand reputation. Overall, the market is expected to continue growing, driven by consumer demand for healthy snacks and the convenience of online purchasing.

What will be the Size of the Almond Kernels Market During the Forecast Period?

- The market is driven by the increasing demand for Tree Nuts, particularly Prunus dulcis or Almonds, due to their rich Vitamins and nutrients. Almonds are obtained from the Almond Tree and are widely used in various industries such as Food and Beverages, Cosmetics, and Baking and Confectionery. The market for Almond Kernels includes various products like Almond Milk, Almond Flour, Almond Butter, Biscuits, Chocolates, Ice Cream, and Almond Oil. The demand for Almond Kernels is influenced by the Vegan trend and the Gluten-free market. Almonds are used as Substitute Nuts for people with nut allergies and are also preferred by Vegans.

- The market for Almond Kernels includes Green Almonds, Shelled Almonds, and Inshell Almonds. The distribution channels for Almond Kernels include Online Retail, Supermarkets, Hypermarkets, Specialty Stores, and Departmental Stores. The Food & Beverage industry, particularly the Bakery and Confectionery sectors, is the largest consumer of Almond Kernels. The market for Almond Kernels is expected to grow significantly due to the increasing popularity of Almond Milk and the rising demand for Gluten-free and Vegan products.

How is this Almond Kernels Industry segmented and which is the largest segment?

The almond kernels industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Application

- Food and beverage industry

- Cosmetics and personal care industry

- Bakery and confectionery industry

- Geography

- North America

- US

- Europe

- Italy

- Spain

- APAC

- Middle East and Africa

- South America

- North America

By Distribution Channel Insights

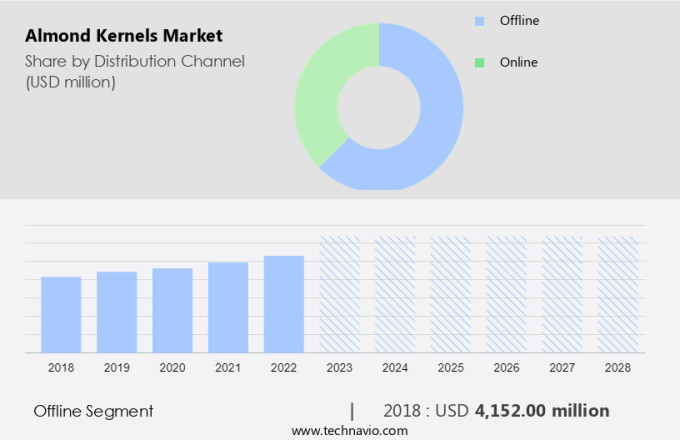

- The offline segment is estimated to witness significant growth during the forecast period.

The global market for Almond Kernels, derived from the Prunus dulcis tree, holds significant value due to their rich nutritional profile and versatility in various food and beverage applications. Almond kernels are a valuable source of Vitamins and nutrients, including Vitamin E, magnesium, and fiber. These tree nuts are widely used in producing almond milk, flour, butter, biscuits, cosmetics, and baked goods. The offline segment dominates the market, with distribution through supermarkets and hypermarkets accounting for a substantial share. These channels enable consumers to examine the product, check for packaging defects, and verify expiration dates before purchase, enhancing consumer confidence.

In developing economies like India and China, where almond kernels are popular snack options, offline sales are particularly significant. The growing vegan trend and the demand for non-dairy alternatives to dairy milk further boosts the market, with almond kernels being a preferred substitute. Almond oil, used in cooking and cosmetics, and almond-based products like ice cream, chocolates, and gluten-free baked goods, also contribute to the market's growth. The distribution channels include online retail, supermarkets, hypermarkets, specialty stores, and departmental stores. Bakers and confectioners are major consumers of almond kernels. The increasing popularity of natural ingredients and the anti-inflammatory and medicinal properties of almonds further fuel market growth. Green almonds and shelled almonds are other forms of almond kernels gaining traction in the market.

Get a glance at the Almond Kernels Industry report of share of various segments Request Free Sample

The offline segment was valued at USD 4.15 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

At WeGotNuts, Blue Diamond Growers, Sunbest Natural, Terrasoul Superfoods, Select Harvest, Harris Family Enterprises, and Mariani Nut, the market is witnessing significant growth. These leading players are prioritizing business practices that cater to the qualitative trends of consumers. For instance, Blue Diamond Growers focuses on sustainable farming methods, while Sunbest Natural focuses on non-GMO and organic certifications. Investors are taking note of the market's potential, as quantitative analysis reveals a steady increase in demand for almond kernels.

Furthermore, companies like Terrasoul Superfoods and Select Harvest are capitalizing on this trend by expanding their product lines and distribution networks. Harris Family Enterprises and Mariani Nut are also investing in research and development to innovate new products and improve existing ones. The competitive outlook of the market is promising, with these key players vying for market share through strategic partnerships, mergers, and acquisitions. As consumer preferences continue to shift towards healthier food options, the demand for almond kernels is expected to remain strong. Overall, the market is a lucrative investment pocket for businesses that prioritize quality, sustainability, and innovation.

Market Dynamics

Our almond kernels market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Almond Kernels Industry?

Increasing awareness about health benefits of almond kernels is the key driver of the market.

- The global market for Almond Kernels, derived from the Prunus dulcis tree, has experienced significant growth due to increasing consumer awareness regarding the nutritional benefits of tree nuts. Almond kernels are renowned for their rich content of essential vitamins and nutrients, including fiber, protein, vitamin E, vitamin B2, phosphorus, manganese, and magnesium. A single ounce of these kernels provides approximately 3.5 grams of fiber, 6 grams of protein, and 14 grams of healthy fats. Almond kernels are also celebrated for their antioxidant properties. These antioxidants shield against oxidative stress, which can potentially harm cells, leading to inflammation, aging, and diseases such as cancer.

- As a result, almond kernels have gained popularity as a healthful addition to various food and beverage applications, including almond milk, almond flour, almond butter, biscuits, cosmetics, ice cream, chocolates, and baked goods. The almond kernel market is further fueled by the growing gluten-free market and the vegan trend. Almond kernels serve as a suitable substitute for dairy milk and non-dairy alternatives, making them a popular choice among consumers seeking nutritious and natural ingredients. Additionally, almond flour and almond oil are widely used in the baking and confectionery industries for their versatility and nutritional benefits. In developing economies, almond kernels are gaining traction as snack options due to their delicious taste and health advantages.

- Furthermore, the market for almond kernels is distributed through various channels, including online retail, supermarkets, hypermarkets, specialty stores, and departmental stores. Consumers can also find almond kernels in the offerings of bakers and authorities in the food and beverage industry. Green almonds and shelled almonds are also gaining popularity in various applications due to their unique flavors and textures. The market for almond kernels is expected to continue growing as consumers increasingly seek natural, healthful ingredients for their diets.

What are the market trends shaping the Almond Kernels Industry?

The rising trend of online distribution platforms is the upcoming trend in the market.

- Almond kernels, derived from the Prunus dulcis tree, are widely used in various food and beverage applications due to their rich vitamins and nutrients. These tree nuts are increasingly popular as a substitute for dairy milk in the vegan trend, resulting in the growth of non-dairy alternatives like almond milk. Almond flour and almond butter are also gaining popularity in the gluten-free market and baking and confectionery industries. Almond oil is used in cosmetics and ice cream production, while chocolates and snack options are other significant markets for almond kernels.

- In developing economies, almonds are used as snack options due to their anti-inflammatory properties and medicinal benefits. The market for almond kernels is expanding through various distribution channels, including online retail, supermarkets, hypermarkets, specialty stores, and departmental stores. E-commerce platforms are becoming essential sales channels due to their convenience and fast delivery services. Major retailers like Amazon, Walmart, Alibaba, and Bigbasket are leading the online grocery market, providing small retailers and companies increased visibility and profitability.

What challenges does Almond Kernels Industry face during the growth?

Stringent government regulations on supplying almond kernels are a key challenge affecting the industry growth.

- The global market for Almond Kernels, derived from the Prunus dulcis tree, has experienced significant growth due to their increasing usage in various food and beverage applications. Almonds are rich in Vitamins and nutrients, making them a popular choice for consumers seeking natural ingredients. In the food industry, almonds find extensive use in producing almond milk, flour, butter, biscuits, and chocolates. They are also used as a non-dairy alternative in ice cream and a substitute for dairy milk in the vegan trend. Almond oil is another derivative with medicinal properties and anti-inflammatory benefits. The almond kernel market caters to various distribution channels, including online retail, supermarkets, hypermarkets, specialty stores, and departmental stores.

- The market is influenced by the growing demand for gluten-free and health-conscious food options. In developing economies, almonds are gaining popularity as snack options. The price and quantity of almond kernels can fluctuate based on supply and demand. Green almonds and inshell almonds are also gaining traction in the market. Manufacturers of food and beverage products, including almond kernel manufacturers, must adhere to stringent regulations imposed by various government agencies in different countries.

Exclusive Customer Landscape

The almond kernels market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry. The almond kernels industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Almond Board of California

- Bapu Farming Co. Inc.

- Belehris Estates

- Blue Diamond Growers

- Chico Nut Co.

- Harris Family Enterprises

- Hilltop Ranch Inc.

- Hormel Foods Corp.

- Olam Group Ltd.

- Orchard Valley

- Retaj Agro Farms

- RPAC LLC

- Select Harvests Ltd.

- South Valley Farms

- Sran Family Orchards

- Steward and Jasper Orchards

- The Wonderful Co. LLC

- Treehouse California Almonds LLC

- Valley Harvest Nut Co.

- Western Nut Co. Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Almond kernels, derived from the Prunus dulcis tree, are popular tree nuts known for their delicious taste and numerous health benefits. Rich in Vitamins E and B2, fiber, protein, and healthy monounsaturated and polyunsaturated fats, almonds are a preferred choice for consumers seeking natural ingredients. The market for almond kernels is thriving in various sectors, including Food and Beverages. Almond milk, flour, butter, and oil are popular almond-based products, finding extensive use in industries like Biscuits, Cosmetics, and Baking and Confectionery. Almonds are also used in the production of Ice cream, Chocolates, and Gluten-free products, catering to the vegan trend and the growing demand for non-dairy alternatives to Dairy milk.

Furthermore, developing economies are witnessing a growth in the consumption of almond kernels due to their anti-inflammatory and medicinal properties. Almonds are now used as Snack options, and consumers prefer them over other substitute nuts due to their superior taste and health benefits. The distribution channels for almond kernels include Online retail, Supermarkets, Hypermarkets, Specialty stores, and Departmental stores. The market is expected to grow further as consumers continue to prioritize natural ingredients in their diet. Green almonds, Shelled almonds, and Inshell almonds are various forms of almonds used in different applications. The Food & Beverage, Bakery, and confectionery industries are the major consumers of almond kernels.

In addition, the price and quantity demanded for almonds depend on their end use and the specific market trends. The market is expected to grow significantly due to the increasing demand for natural ingredients, the vegan trend, and the growing popularity of non-dairy alternatives. The market is diverse, with various applications and distribution channels, making it an exciting and dynamic industry to watch.

|

Almond Kernels Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

153 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 3.98 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

US, Spain, Iran, Australia, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Almond Kernels industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch