Antenna Cable Market Size 2024-2028

The antenna cable market size is forecast to increase by USD 1.51 billion at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. One of the primary drivers is the increasing adoption of cables for broadband Internet access, as more households and businesses rely on high-speed connections. Another trend is the growing investment in the aerospace sector, which requires advanced antenna systems for communication and navigation. Other factors driving the market include infrastructure improvements, urbanization, and the adoption of smart grid technology, fiber optics networks, data centers, IT facilities, and smart home appliances. However, the market is also facing challenges, such as the declining subscriber base for CATV services in several countries, leading to a decrease in demand for traditional coaxial cables. Despite these challenges, the market is expected to continue growing due to the ongoing demand for reliable and high-performance antenna cables in various applications.

What will be the size of the Antenna Cable Market During the Forecast Period?

- The market encompasses a range of cable solutions designed for data transmission and communication in various applications, including building and construction, power transmission, transport, and telecommunications. Key product offerings include RF cables, radiating cables, leaky feeders, and conventional antennas, available in various materials such as copper, aluminum, glass, and coaxial. Market dynamics are driven by trends toward higher frequencies, larger bandwidths, and improved signal quality.

- Medium and high-voltage power transmission applications continue to drive demand for specialized antenna cables, while low-voltage solutions dominate in data transmission and building construction. Geometry, common mode currents, vertical polarization, measurement errors, and interference suppression technologies, such as ferrite toroid suppressors and isolating filters, are critical considerations in antenna cable design. Overall, the market is expected to grow steadily, driven by increasing demand for reliable and high-performance communication and data transmission systems.

How is this Antenna Cable Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Telecommunication

- Radio frequency transfer

- Internet data transfer

- End-user

- Commercial industries

- Military and defense

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

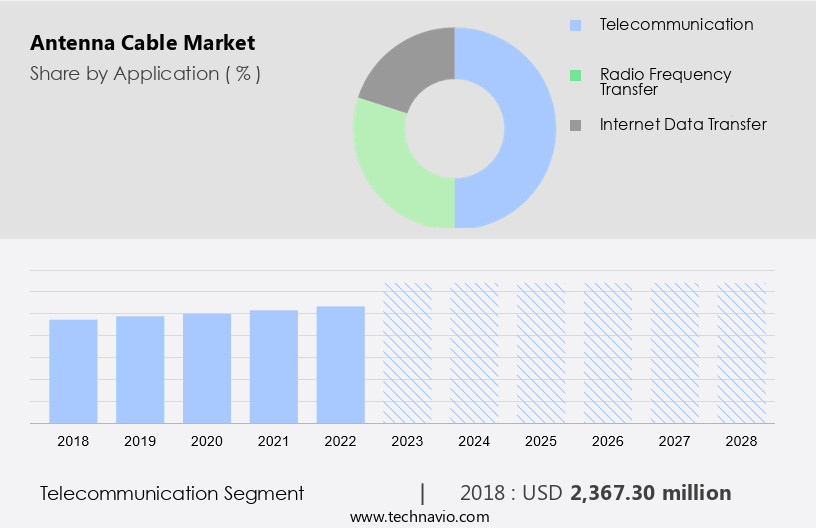

- The telecommunication segment is estimated to witness significant growth during the forecast period.

Antenna cables play a crucial role in transmitting interference-free signals between various telecom equipment, including telephone switching stations, exchanges, mobile communications towers, and satellite transmitters. These cables ensure optimal data and voice quality over networks and are also utilized for wired telephony services in certain regions. The escalating demand for telecommunications is driven by the increasing number of mobile and wireless consumers and the emergence of next-generation technologies. Developing countries in Asia Pacific and the Middle East & Africa present substantial growth opportunities as operators aim to expand their network coverage. Antenna cables come in various types, such as Medium Voltage, High Voltage, Low Voltage, Optical Fiber, Aluminum, Copper, Glass, and more.

They are employed in diverse sectors, including data transmission, power transmission, transport, building and construction, infrastructure improvements, digitalization, automation, submarine cable systems, fiber optics networks, data centers, IT facilities, smart grid technology, and more. Key considerations include raw material costs, lightweight cables for aircraft, renewable energy applications, smart home appliances, installation insights, urbanization, and construction.

Get a glance at the market report of share of various segments Request Free Sample

The Telecommunication segment was valued at USD 2.37 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

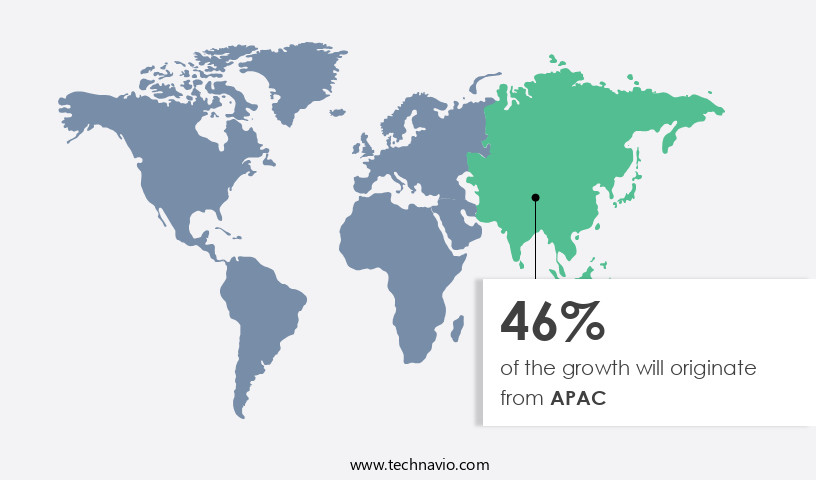

- APAC is estimated to contribute 46% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC holds the largest market share and is poised for significant growth due to increasing demand from digitizing CATV networks, expanding mobile telecommunication networks, and the replacement of DSL Internet with high-speed cable networks. China and Japan are the major consumers of antenna cables in APAC. The region's market growth can be attributed to the growing mobile phone usage in countries like China and India, which is projected to increase substantially by 2025.

Antenna cables are used in various applications such as power transmission, transport, building construction, and overhead installation. They come in different types, including Medium Voltage, High Voltage, Low Voltage, Optical Fiber Cable, Aluminum, Copper, Glass, and various cable systems like Submarine Cable Systems, Fiber Optics Network, and Duplexer. Proper installation and maintenance are crucial to ensure high-frequency performance, electromagnetic compatibility, and minimize cable faults.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Antenna Cable Industry?

The adoption of cables for broadband Internet access is the key driver of the market.

- Antenna cables have evolved from being primarily used for cable television and communication networks to becoming essential components in data transmission and infrastructure improvements. The advent of Multimedia over Coax Alliance (MoCA) technology In the early 2000s revolutionized the use of antenna cables, enabling high-speed broadband Internet and digital content access over existing cable networks.

- Antenna cables are now utilized extensively in various sectors, including Building and Construction, Power Transmission, Transport, and Digitalization. They are integral to smart grids, fiber optics networks, data centers, IT facilities, and smart home appliances. MoCA technology employs various cable types, such as copper, aluminum, glass, and optical fiber cables, to cater to diverse applications. The cables and connectors are designed to minimize errors, ensuring high-frequency performance and electromagnetic compatibility. They feature isolating filters, duplexers, and screening to minimize cable faults and electromagnetic interference. MoCA cables are available in various configurations, including coaxial, ribbon, and twisted pair, catering to different applications and requirements.

What are the market trends shaping the Antenna Cable Industry?

Growing investment In the aerospace sector is the upcoming market trend.

- Antenna cables play a vital role In the aerospace and defense industry, facilitating communication between essential electronic components in military and commercial aircraft. With the increasing demand for aircraft production to meet backlogs and the importance of clear radio communication between aircraft and air traffic control for safety reasons, the use of antenna cables is indispensable.

- These cables ensure the isolation of radio signals, preventing interference and enabling effective communication. In the broader context, the market encompasses various types, including Medium Voltage, High Voltage, and Low Voltage cables, as well as Optical Fiber Cables.

What challenges does the Antenna Cable Industry face during its growth?

Declining CATV subscriber base in several countries is a key challenge affecting the industry growth.

- The market has experienced shifts in consumer preferences, with a decline in traditional CATV subscriptions due to the rise of streaming services, satellite TV, and IPTV-based solutions. Streaming platforms like Netflix, Hulu, and Amazon Prime Video offer monthly access to a vast library of shows at lower costs than traditional CATV subscriptions. These services, also known as Subscription Video-on-Demand (SVoD), provide consumers with the flexibility to pay per-view or subscribe to individual channels, overcoming the limitation of having to pay for an entire channel package to access a specific one. In the cable industry, there are various types of cables used for Data Transmission and Power Transmission, including Medium Voltage, High Voltage, and Low Voltage cables.

- Optical Fiber Cables, made of Glass or Aluminum and Copper conductors, are widely used for Fiber Optics Networks, Data Centers, IT Facilities, and Smart Grid Technology due to their high bandwidth, low error rate, and immunity to electromagnetic interference. Cables and connectors play a crucial role in maintaining High-Frequency Performance and Electromagnetic Compatibility. Common cable types include coaxial cables, Flame-retardant sheaths, and Screened Cables.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amphenol Corp.

- Belden Inc.

- CommScope Holding Co. Inc.

- HUBER SUHNER AG

- Infinite Electronics Inc.

- JV Industries Pvt. Ltd.

- Kingsignal Technology Co. Ltd.

- Leoni AG

- LS Cable and System Ltd.

- Nexans SA

- Prysmian Spa

- Relemac Technologies Pvt. Ltd.

- Southwire Co. LLC

- Sumitomo Electric Industries Ltd.

- Synergy Telecom Pvt. Ltd.

- TE Connectivity Ltd.

- Trexon

- Trigiant Group Ltd.

- W. L. Gore and Associates Inc.

- Zhuhai Hansen Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of products used in various applications, including data transmission and power transmission. These cables can be categorized based on the voltage levels they support, such as medium voltage, high voltage, and low voltage. The primary differences between these categories lie In the insulation materials and the conductor sizes used. Optical fiber cables, another significant segment within the market, utilize glass fibers for data transmission. The use of optical fiber cables has gained popularity due to their high bandwidth, low signal loss, and immunity to electromagnetic interference. Two common conductive materials used in antenna cables are aluminum and copper.

Moreover, copper cables offer better conductivity and are widely used in various applications due to their superior electrical properties. In contrast, aluminum cables are preferred for their lightweight nature and lower cost, making them suitable for specific applications such as power transmission in the aviation industry and renewable energy projects. The construction sector is a significant consumer of antenna cables, with applications ranging from building and construction to infrastructure improvements. The increasing trend towards digitalization, automation, and smart grid technology has led to an increased demand for antenna cables in various sectors, including data centers, IT facilities, and smart home appliances.

Furthermore, submarine cable systems and fiber optics networks are essential components of modern communication infrastructure. These systems require specialized antenna cables designed to withstand harsh marine environments and ensure reliable data transmission. The design and installation of antenna systems involve various considerations, such as geometry, common mode currents, vertical polarization, measurement errors, and error sources like reflector and ferrite toroid suppressors. Proper installation insights are crucial to minimize cable faults and ensure optimal system performance. Urbanization and construction projects have led to an increased focus on reducing cable weight and improving high-frequency performance. Lightweight cables, such as ferrite-loaded cables and filtering techniques like low-pass filtering, are being adopted to address these requirements.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 1.51 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

China, US, Japan, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Antenna Cable Market Research and Growth Report?

- CAGR of the Antenna Cable industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the antenna cable market growth of the industry companies

We can help! Our analysts can customize this antenna cable market research report to meet your requirements.