Fruit Sorting Machinery Market Size 2024-2028

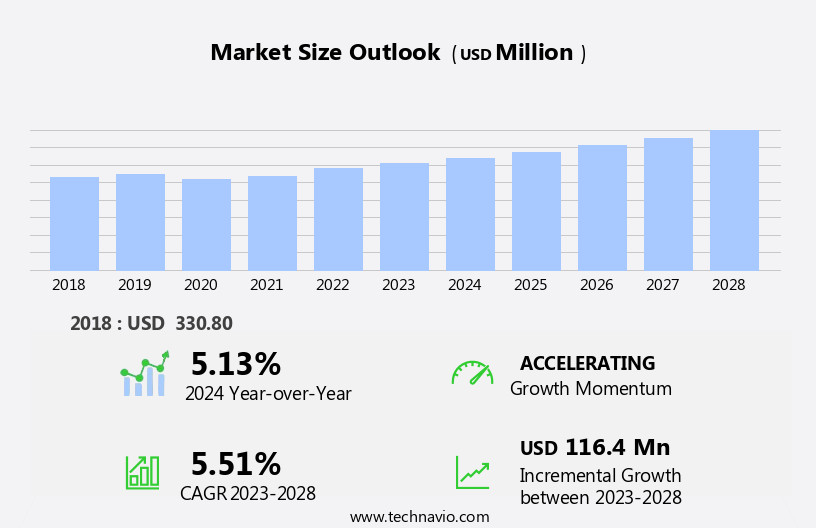

The fruit sorting machinery market size is forecast to increase by USD 116.4 million at a CAGR of 5.51% between 2023 and 2028.

What will be the Size of the Fruit Sorting Machinery Market During the Forecast Period?

How is this Fruit Sorting Machinery Industry segmented and which is the largest segment?

The fruit sorting machinery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Automated fruit sorting machinery

- Mechanical fruit sorting machinery

- Type

- Optical sorting machine

- Weight-based sorting machine

- Geography

- Europe

- Germany

- North America

- US

- APAC

- China

- Japan

- Middle East and Africa

- South America

- Europe

By Application Insights

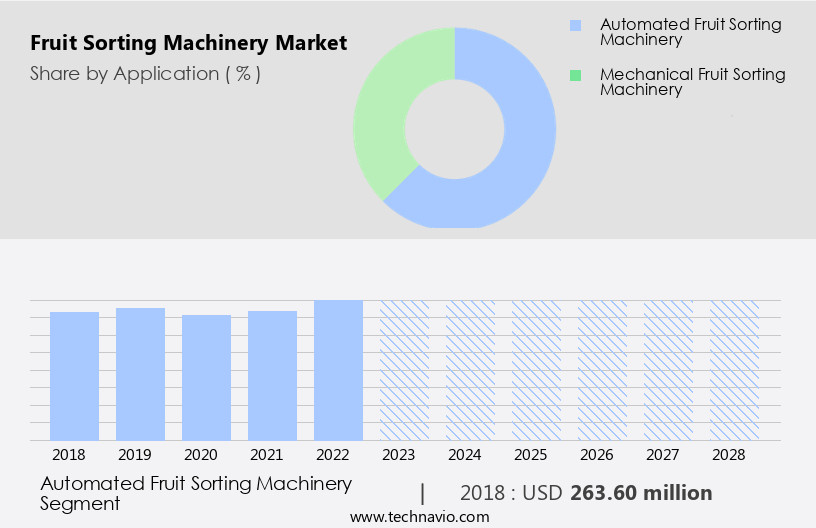

The automated fruit sorting machinery segment is estimated to witness significant growth during the forecast period. Fruit sorting machinery is a crucial component of post-harvest operations In the fruit processing industry. Automated sorting solutions utilize advanced technologies such as optical sorters, mechanical sorters, and manual sorting systems to ensure premium quality fruits with optimal visual appeal, taste, and nutritional value. Optical sorters, which employ cameras and lasers, use color-based and sensor intelligence to segregate fruits based on size, shape, and other structural properties. Mechanical sorting machines, on the other hand, use impact or air pressure to separate fruits based on their weight and size. Frozen fruit, including mangoes, apples, oranges, blueberries, cherries, peaches, and pears, undergo sorting processes before packaging.

Automatic and manual sorting systems are employed in fruit planting bases, fruit processing plants, and fresh produce markets to minimize waste, maximize yield, and adhere to food safety regulations. Sustainable farming practices, such as pre-cooling of fruits and post-harvest treatments, are essential to maintaIn the freshness and extend the shelf life of fruits. Google AI technology, imaging technologies like near-infrared (NIR) spectroscopy and hyperspectral imaging, and waste reduction technologies play a significant role In the fruit sorting process. These innovations help in maturity flaw identification, food waste reduction, and detection of contaminants, foreign objects, diseased specimens, and brand reputation protection.

E-commerce channels and citrus fruits, berries, and stone fruits benefit significantly from these advancements in fruit sorting machinery. Flexibility and versatility are essential in sorting machinery for various fruits and vegetables, as well as for conventional and processed fruits. Producers, packers, and distributors rely on size grading and weight grading systems to meet the demands of consumers and food processing units. Efficiency gains, maintenance and repair, and waste management technologies are essential considerations for fruit sorting machinery investments. The integration of artificial intelligence, computer vision technologies, and precision sorting technologies further enhances the capabilities of fruit sorting machinery.

Get a glance at the market report of various segments Request Free Sample

The Automated fruit sorting machinery segment was valued at USD 263.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

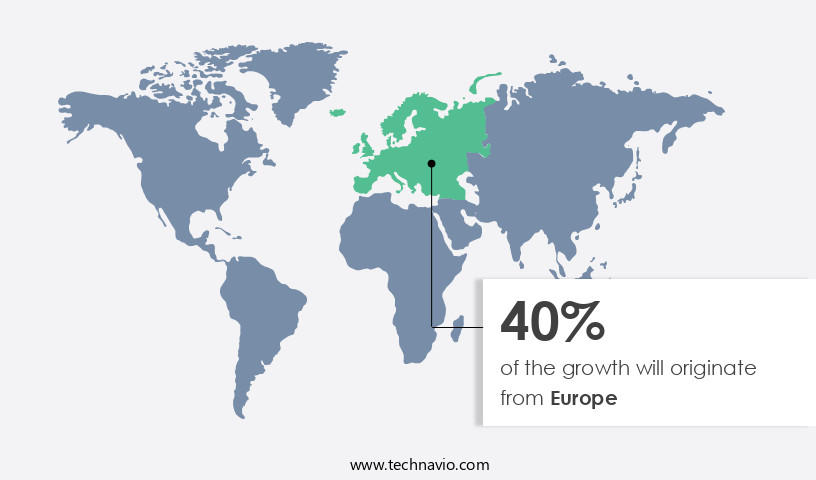

Europe is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The European market for fruit sorting machinery is significant, with key countries including the Netherlands, UK, Germany, and France. Major companies supplying this equipment are TOMRA, Buhler, CFT, and Ellips B.V. The market's growth is fueled by stringent food safety and quality regulations in Europe. Fruit sorting machinery is crucial for detecting and removing defective fruits during handling and packaging, reducing contamination risks and maintaining premium quality. This machinery is essential for compliance with European food safety certifications. Optical and mechanical sorting systems, such as sorters and grading machines, are used for size and weight grading, as well as for identifying maturity flaws, external defects, and contaminants.

Innovative technologies like Google AI technology, imaging technologies (hyperspectral imaging, near-infrared spectroscopy), and machine learning are employed for precision sorting. Fruit processing units, fresh produce markets, and food processing industries utilize these advanced systems for waste minimization, yield maximization, and food safety. Key players prioritize maintenance and repair, efficiency gains, and flexibility and versatility for various fruits, including citrus, berries, stone fruits, and premium quality fruits. Fruit sorting machinery also plays a role in reducing food waste, extending shelf life, and ensuring nutrition labeling and food additives compliance. Waste management technologies and packaging solutions, such as aseptic packaging and ultra-processed foods, are integrated with these systems to maintaIn the freshness and visual appeal of fruits.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Fruit Sorting Machinery Industry?

- Increased focus on quality and safety of food products is the key driver of the market.The market is witnessing significant growth due to the increasing demand for high-quality fruits and the adoption of advanced sorting technologies. Sorting technologies, including optical sorters and mechanical sorters, are increasingly being used in fruit processing plants to ensure premium quality fruits with superior visual appeal, taste, and nutritional value. These systems facilitate the identification and rejection of fruits with maturity flaws, external defects, and contaminants, thereby reducing food waste and maximizing yield. Frozen fruits, such as mangoes, apples, oranges, blueberries, cherries, peaches, and pears, are major applications of fruit sorting machinery. The use of these machines In the fruit planting base and post-harvest operations, including pre-cooling, post-harvest treatments, and packaging, is essential for maintaining food safety regulations and minimizing contamination risks.

Automatic sorting solutions, such as imaging technologies using near-infrared (NIR) spectroscopy and hyperspectral imaging, are increasingly being adopted for waste minimization and yield maximization. These technologies enable the detection and rejection of diseased specimens, foreign objects, and other contaminants, ensuring the production of high-quality fruit products. Innovative packaging technology, including aseptic packaging, plays a crucial role in extending the shelf life of fresh fruits and processed fruit products. Nutrition labeling and food additives are also essential considerations for the food processing industries. Waste management technologies and maintenance and repair services are essential for ensuring the efficiency gains of these sorting systems.

The market dynamics of fruit sorting machinery are influenced by factors such as labor costs, artificial intelligence, computer vision technologies, precision sorting, and advanced sensors. The flexibility and versatility of these systems make them suitable for various applications, including fruits and vegetables, citrus fruits, berries, and stone fruits. Producers, packers, distributors, and food processing units are the key stakeholders In the market. Size grading and weight grading systems are also essential components of the market. The market is expected to continue growing due to the increasing demand for fresh produce markets and the adoption of automation in food processing units.

What are the market trends shaping the Fruit Sorting Machinery market?

- Growing strategies between fruit sorting machine manufacturers and IT companies is the upcoming market trend.The market is witnessing significant advancements as companies collaborate with technology companies to integrate digital features into their sorting equipment. For instance, Kezzler, a specialist in product serialization and traceability, recently received a 14% ownership stake from TOMRA through a strategic investment. This investment, which involved purchasing secondary shares and participating In the company's rights issue, enables TOMRA to expand its offerings and align with its goal of driving the resource revolution and doubling its sales by 2027. In the realm of fruit sorting machinery, various technologies are employed, including optical and mechanical sorters, and manual sorting systems.

Automatic sorting solutions have gained popularity due to their efficiency gains and ability to handle large volumes. Fruits such as Frozen Fruit, Mangoes, Apples, Oranges, Blueberries, Cherries, Peaches, and Pears are commonly sorted using these machines. Sorting technologies play a crucial role in post-harvest operations, ensuring premium quality fruits based on visual appeal, taste, nutritional value, ripeness, and size. These systems help In the detection and rejection of contaminants, such as foreign objects, diseased specimens, and external defects. Innovative packaging technologies, such as aseptic packaging, are also integrated into the sorting process to extend shelf life and maintain food safety.

Google AI technology, maturity flaw identification, and waste reduction are essential aspects of modern fruit sorting machinery. Food waste reduction is a significant concern In the context of urban areas and the growing demand for health and wellness. Fruit grading machines are employed in fresh produce markets and food processing units to ensure consistent quality and size grading. Sustainable farming practices, pre-cooling of fruits, and post-harvest treatments are essential components of the fruit processing industry. Waste management technologies and maintenance and repair services are also critical for optimal performance and minimizing downtime. Food safety regulations and contamination risks are major concerns for producers, packers, and distributors.

Detection systems and rejection systems are employed to minimize the risk of product recalls and protect brand reputation. E-commerce channels have further increased the demand for automated sorting solutions, as they require high-quality, consistent fruit for online sales. Citrus fruits, berries, and stone fruits are popular categories In the market due to their flexibility and versatility. Size grading and weight grading systems are essential for ensuring consistent product quality and meeting customer expectations. In conclusion, the market is driven by the need for efficient, accurate, and sustainable sorting solutions. companies are investing in advanced sensors, machine learning, and computer vision technologies to meet the evolving demands of the industry.

The market is expected to grow as the demand for premium quality fruits, visual appeal, taste, and nutritional value continues to increase.

What challenges does the Fruit Sorting Machinery Industry face during its growth?

- Fluctuating raw material prices is a key challenge affecting the industry growth.Fruit sorting machinery is essential in post-harvest operations for ensuring premium quality fruits with optimal visual appeal, taste, and nutritional value. Various sorting technologies, including optical and mechanical sorters, are employed to automate the sorting process. Optical sorters utilize imaging technologies, such as near-infrared (NIR) spectroscopy and hyperspectral imaging, for maturity flaw identification, waste reduction, and yield maximization. Mechanical sorters, on the other hand, rely on size and weight grading systems for sorting conventional fruits. Manual sorting systems are still prevalent in smaller-scale fruit processing units, but automatic sorting solutions are increasingly gaining popularity due to their efficiency gains and food safety benefits.

Fruits and vegetables, including Frozen Fruit such as Mangoes, Apples, Oranges, Blueberries, Cherries, Peaches, and Pears, undergo various pre-cooling, post-harvest treatments, and packaging processes. Google AI technology is being integrated into sorting machinery for advanced sensing, machine learning, and precision sorting. Food waste reduction is a critical concern In the fruit processing industries, with innovative packaging technology, waste management technologies, and nutrition labeling playing essential roles. Food additives and aseptic packaging are used to extend the shelf life of processed fruit products. Fruit grading machines are crucial in maintaining food safety regulations and minimizing contamination risks, such as contaminants and foreign objects, which can lead to product recalls and damage to brand reputation.

Flexibility and versatility are essential in sorting machinery for handling various fruits and vegetables, citrus fruits, berries, and stone fruits. Producers, packers, and distributors rely on these advanced systems to cater to the demands of fresh produce markets, e-commerce channels, and food processing units.

Exclusive Customer Landscape

The fruit sorting machinery market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fruit sorting machinery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fruit sorting machinery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ATS Automation Tooling Systems Inc. - The market encompasses advanced technologies such as Optical and X-ray sorters, including the Ingenuity, Opportunity, Dryce, and CURIOSITY models. These systems utilize innovative techniques to automatically sort and grade fruits based on various parameters, ensuring high-quality produce and increased efficiency in processing operations. The integration of advanced imaging and sensing technologies enables precise identification and sorting of fruits, reducing human error and enhancing overall productivity. These machines cater to various applications withIn the fruit processing industry, providing a valuable solution for businesses seeking to optimize their operations and maintain consistent product quality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ATS Automation Tooling Systems Inc.

- Aweta G and P BV

- Buhler AG

- Crux Agribotics BV

- De Greefs Wagen Carrosserie en Machinebouw BV

- Duravant LLC

- Ellips BV

- Eshet Eilon Industries LTD.

- Futura Srl

- GP Graders

- Grote Co. Inc.

- John Bean Technologies Corp.

- Maf Roda

- Pigo S.r.l.

- Quadra Machinery

- Reemon Technology Holdings Co. Ltd.

- Sesotec GmbH

- SHIBUYA Corp.

- Techik Instrument Shanghai Co. Ltd.

- Tomra Systems ASA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses various technologies designed to automate and improve the efficiency of sorting fruits during post-harvest operations. These sorting systems cater to the increasing demand for premium quality fruits with consistent visual appeal, taste, and nutritional value. The market spans a diverse range of fruits, including but not limited to, mangoes, apples, oranges, blueberries, cherries, peaches, and pears. Sorting technologies encompass optical sorters, mechanical sorters, and manual sorting systems. Optical sorters utilize imaging technologies, such as near-infrared (NIR) spectroscopy and hyperspectral imaging, to identify maturity flaws, ripeness, and external defects. Mechanical sorters employ size and weight grading systems to separate fruits based on physical characteristics.

Manual sorting systems remain essential for irregular fruits and those with complex external features. Automation plays a significant role In the market, with automatic sorting solutions offering efficiency gains and waste minimization. These systems enable producers, packers, distributors, and food processing units to meet the stringent food safety regulations and reduce contamination risks. Food safety is a critical concern In the fruit processing industries, with potential contaminants ranging from foreign objects to diseased specimens. The market for fruit sorting machinery is driven by the need to minimize waste and maximize yield. Advanced sensors, machine learning, and artificial intelligence are increasingly being adopted to optimize sorting processes and improve overall operational efficiency.

Flexibility and versatility are essential factors In the design of sorting equipment, allowing for the handling of various fruits and processed fruit products, such as frozen fruit and aseptically packaged items. The market is influenced by several factors, including food waste reduction, waste management technologies, and the growing trend towards sustainable farming practices. The market is also impacted by the increasing popularity of health and wellness, with urban areas showing a significant demand for fresh fruits and minimally processed food products. E-commerce channels have transformed the way fruits are sold and distributed, necessitating the need for efficient and reliable sorting solutions.

Citrus fruits and berries, in particular, require specialized sorting equipment due to their unique characteristics. Stone fruits, such as peaches and cherries, also benefit from advanced sorting technologies to ensure consistent quality and minimize waste. The market is continually evolving, with innovative packaging technology and nutrition labeling playing a crucial role In the market's growth. Food additives and ultra-processed foods are becoming increasingly common, necessitating the adoption of advanced sorting technologies to maintain product quality and safety. Maintenance and repair of sorting machinery is an essential consideration for producers and processors, with efficiency gains and cost savings being key drivers for investing in reliable and durable equipment.

The market for fruit sorting machinery is expected to grow significantly In the coming years, driven by the increasing demand for premium quality fruits and the need to minimize waste and maximize yield.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.51% |

|

Market growth 2024-2028 |

USD 116.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.13 |

|

Key countries |

US, The Netherlands, Germany, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fruit Sorting Machinery Market Research and Growth Report?

- CAGR of the Fruit Sorting Machinery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fruit sorting machinery market growth of industry companies

We can help! Our analysts can customize this fruit sorting machinery market research report to meet your requirements.