Membrane Market For Food And Beverage Processing Size 2025-2029

The Membrane Market For Food And Beverage processing size is forecast to increase by USD 2.66 billion at a CAGR of 7.1% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing focus on reducing food contamination and ensuring product safety. Single-use membrane technologies have gained popularity in the food and beverage industry due to their ease of use and effectiveness in removing contaminants. The market is also witnessing an increase in the usage of a variety of polymeric materials for membrane production, offering improved filtration efficiency and longer membrane life. Furthermore, the prevailing water crisis and water pollution concerns have led to the adoption of membrane technologies for zero discharge systems in food and beverage processing. Additionally, they are employed for the concentration of valuable components like cheese whey proteins, or milk in the dairy industry, as well as for the concentration of juices and sugars in the cereal processing industry. However, challenges such as fouling and high operational costs associated with some membrane technologies using Seawater as feedwater continue to pose a threat to market growth. Advanced filtration technologies like Forward Osmosis (FO) are being explored to mitigate these challenges and offer cost-effective and sustainable membrane solutions for the food and beverage industry.

What will be the Membrane Technology for Food and Beverage Processing Market Size During the Forecast Period?

-

The food and beverage processing membrane market growth, is driven by escalating concerns over wastewater treatment, freshwater scarcity, and stringent regulatory mandates. As the global water crisis and rising pollution intensify, sustainability requirements are fueling the adoption of advanced filtration and separation technologies. Ultrafiltration (UF), microfiltration (MF), nanofiltration (NF), reverse osmosis (RO), and pervaporation are increasingly being utilized for efficient water conservation and recycling. Small and mid-sized players in dairy processing, beverage processing, and food & starch processing are leveraging these technologies to secure potable water from diverse sources, including seawater and municipal sewage. Additionally, innovations in gas separation are further expanding membrane applications across the industry.

-

Polymeric materials such as PVDF, PES, and PA are commonly used in membrane production for NF segment applications. Moreover, Zero discharge initiatives and desalination plants are also contributing to the market growth. However, capital cost and fouling remain challenges for the membrane market. FO technology and ion exchange technology are emerging solutions to address these challenges. Numerous regulatory bodies are implementing stringent regulations to ensure the use of sustainable and efficient water treatment methods, further boosting the market growth

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Polymeric

- Ceramic

- Others

- Technology

- Microfiltration

- Reverse osmosis

- Ultrafiltration

- Nanofiltration

- Others

- Geography

- Europe

- Germany

- France

- North America

- Canada

- US

- APAC

- China

- Middle East and Africa

- South America

- Europe

By Material Insights

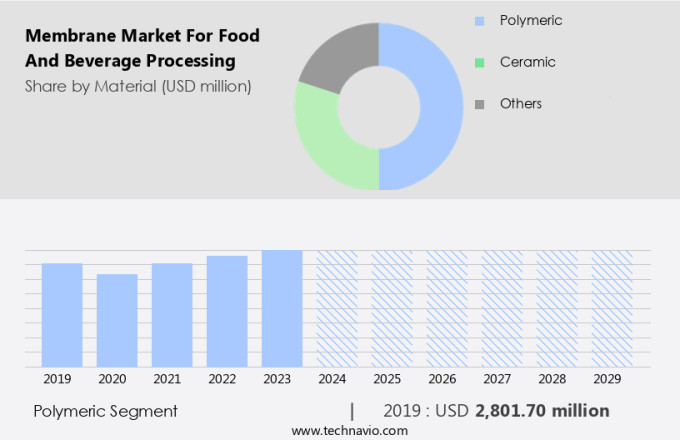

- The polymeric segment is estimated to witness significant growth during the forecast period.

Polymeric membranes, a crucial component in food and beverage processing, are thin, semipermeable barriers primarily composed of polymers. These membranes serve as essential filtration and separation tools due to their versatile capabilities, including high selectivity, ease of separation, and the ability to be functionalized and modified. In the context of food processing, they are extensively utilized for various applications such as water conservation and recycling in plant operations. Additionally, they are employed for the concentration of valuable components like cheese, whey proteins, or milk in the dairy industry, as well as for the concentration of juices and sugars in the cereal processing industry.

Furthermore, polymeric membranes play a significant role in wastewater treatment in meat and fish processing industries. Notable polymers used in membrane production include PVDF, PES, PA, and NF membranes.

Get a glance at the market report of share of various segments Request Free Sample

The polymeric segment was valued at USD 2.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

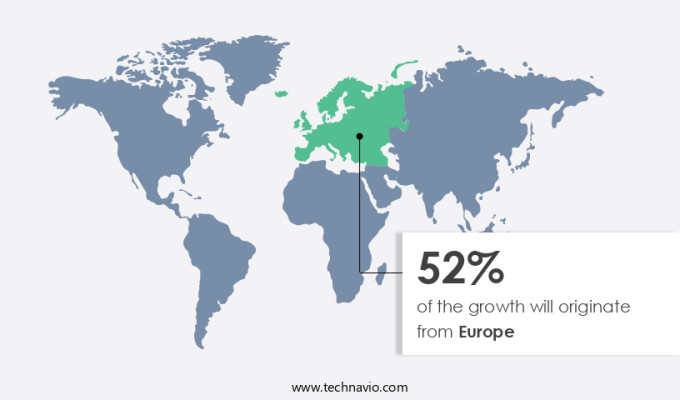

- Europe is estimated to contribute 52% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In Europe, the membrane market for food and beverage processing is experiencing significant growth due to the increasing adoption of membrane technology for water conservation and recycling in the production of various food and beverage items. Membrane filtration using polymeric materials such as Polyvinylidene Fluoride (PVDF), Polyethersulfone (PES), Polyamide (PA), and Nanofiltration (NF) membranes is increasingly being used in the processing of food and beverages, particularly in the production of fruit juice concentrates, dairy products, beer, wine, and other beverages. European countries, including the UK, Romania, Ukraine, and others, are major exporters of concentrated orange and apple juices, while Germany, Russia, the UK, Poland, and Spain are key producers of beer. Moreover, there is a rising trend in dairy production across various European nations, such as Germany, the UK, Spain, France, Ireland, the Netherlands, and others. This increasing demand for food and beverage products, coupled with the need for water conservation and recycling, is driving the growth of the membrane market in Europe.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Membrane Market For Food And Beverage Processing Market ?

Increasing focus on reducing food contamination is the key driver of the market.

- The food and beverage processing industry faces a significant challenge in ensuring the purity and safety of their products due to the issue of contamination, primarily caused by microorganisms. This contamination can lead to foodborne illnesses and various health concerns, particularly in the dairy industry. Wastewater treatment is crucial in preventing the spread of bacteria and other microorganisms from process fluids, such as water, coming into contact with wet surfaces.

- Regulatory and sustainability mandates necessitate the implementation of advanced filtration technologies to maintain the highest standards of potable water usage. Membrane filtration technology, specifically, has emerged as an effective solution for detecting and eliminating microbial contaminants from food products. Small players in the industry are increasingly adopting membrane filtration systems due to their cost-effectiveness and efficiency. Membrane filters offer a reliable and sustainable solution for food processing industries seeking to mitigate the risks associated with contamination.

What are the Membrane Technology for Food and Beverage Processing market trends ?

The increase in usage of variety of polymeric materials is the upcoming trend in the market.

- Membranes, fabricated from diverse polymers and materials, have gained significant traction in the food and beverage processing industry due to the increasing focus on wastewater treatment, sustainability mandates, and freshwater scarcity. Notably, polymeric materials such as Polyethersulfone (PES), polytetrafluoroethylene (PTFE), and Polyvinylidene fluoride (PVDF) have emerged as popular choices.

- PES, an amorphous thermoplastic polymer, offers desirable mechanical properties, including high strength and stability at elevated temperatures up to 428°F. Its hydrophilic nature and low protein binding characteristics render it suitable for producing membranes with a controllable pore size of approximately 40 nanometers. These membranes find extensive applications in the production of potable water and fermented beverages. Small players in the market are increasingly investing in membrane technology to meet regulatory mandates and cater to the growing demand for sustainable and cost-effective water treatment solutions.

What challenges does Membrane Market For Food And Beverage Processing Market face during the growth?

Prevailing usage of alternate filtration technologies is a key challenge affecting market growth.

- Membrane filtration has emerged as a preferred method for wastewater treatment in the food and beverage processing industry due to its ability to produce high-quality filtrate. However, for small-scale industries, the high capital cost of membrane technology may deter adoption. In contrast, traditional filtration techniques such as distillation and crystallization continue to be popular. In distillation, a liquid mixture is purified by selectively evaporating and condensing components. This process is widely used in the food industry for the concentration of beverages, flavors, essential oils, and other components.

- Crystallization, a solid-liquid separation technique, converts liquids into crystalline form for purification. It is commonly used in food production for the manufacture of sugar, lactose, glucose, and salt. However, as freshwater scarcity and regulatory mandates for sustainability gain prominence, there is a growing shift towards membrane technology in the food and beverage processing industry. Despite the initial high capital cost, membrane filtration offers long-term cost savings and improved product quality, making it a more sustainable and economically viable option for large-scale operations.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co - The company offers three types of membrane cartridges for food and beverage such as BA, BLA, BNA.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Laval AB

- Aquamarijn Micro Filtration BV

- Berkshire Hathaway Inc.

- DuPont de Nemours Inc.

- Filtration Group Corp.

- GEA Group AG

- H2O Innovation Inc

- Kovalus Separation Solutions Inc.

- Lanxess AG

- MANN HUMMEL International GmbH and Co. KG

- MEGA AS

- Merck KGaA

- MMS AG

- Nitto Denko Corp.

- Pentair Plc

- Synder Filtration Inc.

- TAMI Industries SAS

- Toray Industries Inc.

- Veolia Environnement SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Development and News

- In January 2024, the Membrane Technology for Food and Beverage Processing Market experienced significant growth, with industry experts highlighting advancements in membrane filtration techniques to enhance efficiency and sustainability in food production.

- In 2023, membrane separation technology saw increased adoption across food and beverage applications, driven by rising demand for high-quality processing methods and improved filtration capabilities.

- In 2021, a review emphasized the widespread application of membrane processes in the food industry, particularly in dairy, wine, beer, fruit juice, and sugar sectors, enabling enhanced product quality and safety.

- In 2020, studies highlighted that membrane technology gained preference in the food industry due to its lower operational costs, increased efficiency, and reduced processing times compared to conventional filtration methods.

Research Analyst Overview

The membrane market for food and beverage processing is witnessing significant growth due to the increasing focus on water conservation and water recycling in the face of freshwater scarcity and regulatory mandates. Membrane technologies, including nanofiltration (NF), reverse osmosis (RO), and microfiltration (MF), are gaining popularity for their ability to remove impurities such as particles, suspended solids, and dissolved salts from water. Polymeric materials like Polyvinylidene Difluoride (PVDF), Polyethersulfone (PES), and Polyacrylonitrile (PAN) are commonly used in the production of membranes for water treatment applications. NF membranes are particularly effective in removing dissolved salts and organic compounds, while RO membranes are ideal for desalination and producing high-quality water for various industries, including pharmaceuticals and biopharmaceuticals.

Additionally, water technologies, such as pervaporation and ion exchange, are also gaining traction in the market due to their ability to provide zero discharge and improve water purification for irrigation purposes. However, the high capital cost of membrane technologies remains a challenge for small players in the market. Fouling and membrane fouling technology are ongoing areas of research to improve the efficiency and sustainability of membrane technologies. The market is expected to grow further due to the increasing water crisis and water pollution issues, with desalination plants and municipal sewage treatment being major applications for membrane technologies.

|

Membrane Technology for Food and Beverage Processing Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 2.66 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, Germany, France, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch