Smart Fleet Management Market Size 2024-2028

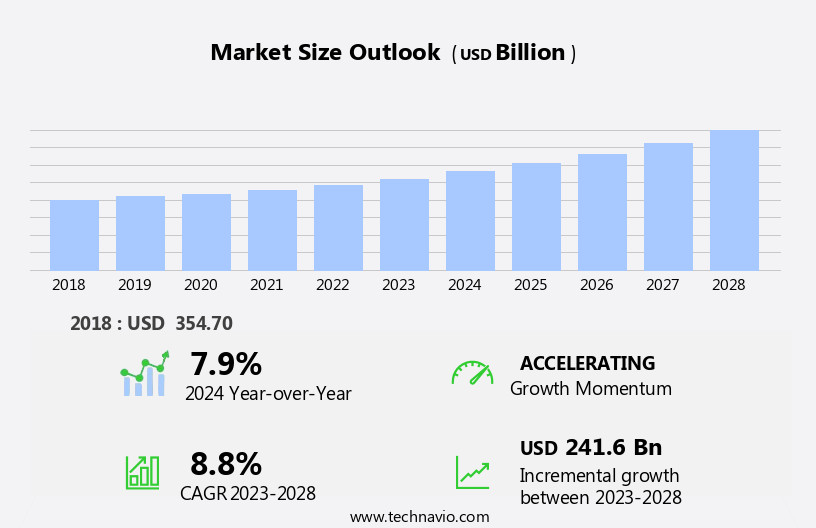

The smart fleet management market size is forecast to increase by USD 241.6 billion at a CAGR of 8.8% between 2023 and 2028.

- The Smart Fleet Management market is experiencing significant growth driven by several key factors. Government regulations mandating efficient fleet operations and the increasing adoption of fleet telematics, autonomous vehicles, and electric vehicles are major growth drivers. Fleet operators across various transportation mediums are increasingly relying on real-time monitoring and vehicle tracking through cloud-based technology and fleet tracking systems. These IoT-enabled solutions enable fleet owners to effectively manage their assets, optimize fuel consumption, leverage predictive maintenance for proactive vehicle upkeep, and ensure two-way communication between vehicles and the server. This facilitates improved logistics and operational efficiency. However, cybersecurity concerns and the need for robust security features within these intelligent transportation systems pose challenges to market growth. Despite these challenges, the market is expected to witness continued expansion as fleet management becomes an integral part of modern business operations across various industries.

What will be the Size of the Smart Fleet Management Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing adoption of connectivity in various modes of transportation, including ships and road vehicles. A smart transport system is a solution that integrates real-time monitoring, data analysis, automation in automotive sector and security features to enhance transport safety, reduce energy consumption, and improve fleet operators' efficiency. Governing bodies and legislations are playing a crucial role in promoting the adoption of electric vehicles , smart fleet management systems. These systems help in reducing theft activities and road accidents by providing real-time alerts and anti-theft notifications. Fleet operators can effectively manage their fleet by optimizing route planning, vehicle maintenance, and driver performance.

- Moreover, smart fleet management solutions enable real-time monitoring of fuel consumption and provide data analysis to help fleet operators make informed decisions. The integration of security features ensures the safe transmission of data to a remote server, providing peace of mind to fleet operators. In conclusion, the market is transforming the transportation medium by offering advanced features to enhance safety, efficiency, and productivity.

How is this Smart Fleet Management Industry segmented and which is the largest segment?

The smart fleet management industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Tracking

- ADAS

- Optimization

- Fuel cards

- Automatic vehicle identification

- Type

- Roadways

- Railroad

- Marine

- Aviation

- Connectivity

- Short

- Long

- Cloud

- Software

- Tracking

- Optimization

- Geography

- APAC

- China

- Japan

- India

- Europe

- Germany

- UK

- Spain

- North America

- US

- Canada

- Middle East and Africa

- South Africa

- South America

- Brazil

- APAC

By Application Insights

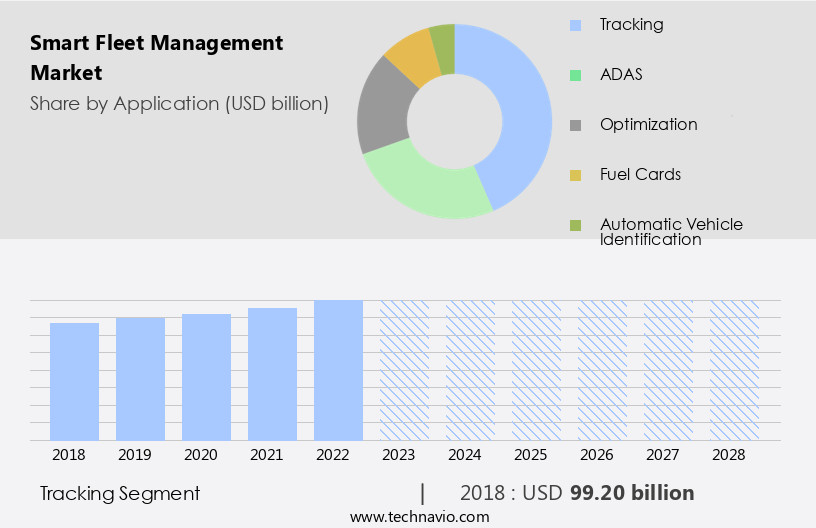

- The tracking segment is estimated to witness significant growth during the forecast period.

Smart fleet management solutions have gained significant traction In the production and operation of vehicle fleets due to their potential to enhance efficiency and productivity. Real-time monitoring of vehicle locations and movements, facilitated by GPS tracking devices, enables fleet managers to optimize routes, minimize idling time, and reduce unnecessary travel. This technology also allows for the remote monitoring of driver performance, energy consumption, collisions, and theft activities, ensuring a high level of security and accountability. With the increasing penetration rates of connectivity types such as 4G and 5G, the growth potential for smart fleet management systems is immense. Governing bodies are also promoting the adoption of these systems to minimize road accidents and improve overall transport system performance.By integrating real-time traffic data and advanced analytics, fleet managers can make informed decisions, ultimately leading to a more efficient and profitable fleet production.

Get a glance at the Smart Fleet Management Industry report of share of various segments Request Free Sample

The Tracking segment was valued at USD 99.20 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

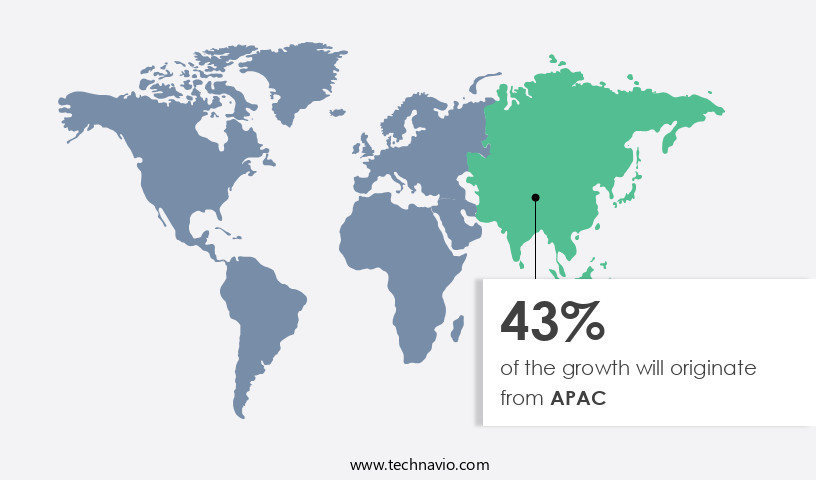

- APAC is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth due to increasing vehicle production and fleet penetration rates. Real-Time Monitoring technology is a key driver of this market, enabling efficient tracking of collisions, energy consumption, and driver performance. Connectivity type, including 3G, 4G, and satellite, is a crucial factor In the market's growth potential. Governing bodies' focus on fleet safety regulations has mandated transportation OEMs to install safety features, leading to market expansion. The APAC region, particularly China, India, Japan, Malaysia, Australia, and Singapore, will witness the highest growth due to the surge in transport facilities and changing socioeconomic conditions. The rise of e-commerce and the need for logistics companies to enhance fleet management efficiency and customer service are also fueling market growth.

The Smart Transport System is essential for tracking goods status, ensuring timely delivery and improving overall operational efficiency. Theft activities and road accidents are significant challenges for fleet operators, making the implementation of smart fleet management systems increasingly important.

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart fleet management market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avnet Inc.

- Cisco Systems Inc.

- CLM Fleet Management Plc

- Continental AG

- Cyrrup Solutions Pvt. Ltd.

- DENSO Corp.

- FleetGO Group Ltd.

- Fleetsmart

- International Business Machines Corp.

- Oracle Corp.

- ORBCOMM Inc.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Siemens AG

- Semtech Corp.

- Speedcast

- Tech Mahindra Ltd.

- TomTom NV

- Total Motion Ltd.

- Trakm8 Holdings Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Dynamics

Our smart fleet management market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.The market is witnessing significant growth, driven by the increasing adoption of IoT, AI, and advanced telematics technologies. Key drivers include stringent government regulations, the rise of autonomous vehicles, and the growing emphasis on data-driven decision-making. Fleet operators are leveraging IoT devices, such as GPS trackers and telematics systems, to optimize routes, improve fuel efficiency, and enhance driver safety. AI algorithms enable predictive maintenance, while ADAS technologies contribute to enhanced vehicle safety. This market presents significant opportunities for businesses seeking to improve operational efficiency, reduce costs, and gain a competitive edge in the evolving transportation landscape.

What are the key market drivers leading to the rise In the adoption of Smart Fleet Management Industry?

Government regulations for fleet management is the key driver of the market.

- The market is experiencing significant growth due to increasing subsidies from governments worldwide to promote efficient fleet management. Governments in countries such as the US, China, and Russia are implementing initiatives to enhance transport safety and reduce operational costs for fleet operators. These regulations, aimed at ensuring compliance with international safety standards, are driving the demand for advanced fleet management solutions. Solution providers are responding to the legal requirements and fleet operators' needs by offering comprehensive systems that monitor and optimize the performance of various modes of transportation, including ships, vessels with containers, automotive, and rolling stock. By utilizing connectivity and data analysis, these solutions enable fleet operators to improve safety, reduce fuel consumption, and increase productivity.

- The competition in this market is intense, with secondary sources and paid databases providing valuable insights to market experts employing a bottom-up approach for business intelligence.

What are the market trends shaping the Smart Fleet Management Industry?

Increasing adoption of telematics and autonomous vehicles, and growing incorporation of electronic vehicles in company fleet is the upcoming market trend.

- The market is driven by the integration of advanced technology, such as telematics, in various modes of transportation, including ships, vessels with containers, automotive, and rolling stock. Connectivity solutions enable real-time monitoring and analysis of fleet performance, ensuring compliance with legislations and enhancing transport safety. Telematics applications, such as adaptive headlights, frontal crash avoidance systems, adaptive cruise control, and rear-view cameras for parking assistance, have significantly reduced the number of accidents. Autonomous vehicles, a futuristic innovation, are self-driven and operate without human intervention using technologies like GPS, LIDAR, radar, and advanced control systems. Although the acceptance of autonomous vehicles is still in its infancy, the competition mapping, secondary sources, and paid databases suggest a promising growth trajectory during the forecast period.

- Fleet management experts employ a bottom-up approach to optimize fleet operations and ensure efficient utilization of resources.

What challenges does the Smart Fleet Management Industry face during its growth?

Fleet data management issues is a key challenge affecting the industry growth.

- In the realm of fleet management, the integration of connectivity and technology has revolutionized the mode of transportation for various industries, including maritime, automotive, and rail. This transformation is driven by the need for comprehensive data management to comply with legislations and prioritize transport safety. The use of cloud and mobile solutions has become increasingly popular, enabling real-time access to data from vessels, ships, containers, and rolling stock. Expert insights suggest that this trend will continue as competition mapping intensifies, and secondary sources and paid databases become essential tools for operators. The focus on performance management and regulatory reporting necessitates the collection and analysis of vast amounts of data, which can inform decisions related to fuel efficiency, maintenance schedules, and route optimization.

- The bottom-up approach to fleet management, which involves gathering data from various sources, is now a critical success factor in this dynamic and competitive landscape.

Exclusive Customer Landscape

The smart fleet management market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart fleet management market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Lastest News and Recent Developments

-

In January 2024, Teltonika Telematics launched its new FMB960, a multi-purpose telematics device with advanced features such as 4G LTE connectivity, GNSS positioning, and enhanced fuel monitoring capabilities. This device is designed to meet the evolving needs of modern fleet management solutions, including real-time tracking, fuel efficiency optimization, and driver behavior analysis.

-

In March 2023, Verizon Connect acquired Fleetmatics, a leading provider of fleet management and mobile workforce solutions. This acquisition expanded Verizon Connect's global reach and strengthened its position in the telematics market, providing customers with a wider range of integrated solutions.

-

In June 2022, Google Cloud partnered with several major logistics companies to develop a joint venture focused on leveraging AI and machine learning to optimize fleet operations, improve route planning, and enhance predictive maintenance capabilities.

-

In September 2021, Samsara, a leading provider of connected operations platform, announced a significant expansion of its European operations, including new data centers and enhanced customer support. This move reflects the growing demand for connected fleet management solutions across the European market.

Research Analyst Overview

Smart fleet management is a mode of transportation that leverages digital technology application and connectivity to enhance the operational efficiency and productivity of fleet operations. This solution includes real-time monitoring, vehicle maintenance, fuel management, route planning, and driver behavior analysis. The connectivity type can be short-range or long-range, with cloud connectivity providing seamless infrastructure improvement and transportation improvement. Governing bodies and legislations play a crucial role In the growth potential of smart fleet management, with transport safety, energy consumption, and carbon emissions being key concerns. Fleet operators manage various types of transportation mediums, including ships, vessels with container loading, automotive, and rolling stock.

Smart fleet management technologies incorporate telematics, smart surveillance, real-time alerts, and two-way communication for asset management and cost savings. Fleet optimization is achieved through fleet tracking, fuel analytics, driving patterns, and autonomous dispatching. The market for smart fleet management is witnessing innovation in products, such as intelligent transportation systems, fleet optimization solutions, and cloud management solutions. However, cyber security concerns and data theft are major challenges that need to be addressed. Fleet owners benefit from cost-effective measures, such as remote diagnostics, real-time monitoring, and maintenance requirements. The bottom-up approach to fleet production and penetration rates of vehicle production indicate a significant growth potential for this market.

Smart fleet management solutions offer fleet operators real-time information, cost savings, and improved operational efficiency. The integration of hardware type, such as tracking devices and remote servers, with cloud-based technology provides security features and intelligent transportation system capabilities. In summary, smart fleet management is a growing market that offers significant benefits to fleet operators through the application of digital technology, connectivity, and fleet optimization solutions. The challenges include cyber security concerns and the need for infrastructure improvement, but the potential for cost savings, increased productivity, and improved safety make it an attractive investment for fleet owners.

|

Smart Fleet Management Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.8% |

|

Market growth 2024-2028 |

USD 241.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.9 |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Fleet Management Market Research and Growth Report?

- CAGR of the Smart Fleet Management industry during the forecast period

- Detailed information on factors that will drive the Smart Fleet Management growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart fleet management market growth of industry companies

We can help! Our analysts can customize this smart fleet management market research report to meet your requirements.