North America Flexible Packaging Market Size 2024-2028

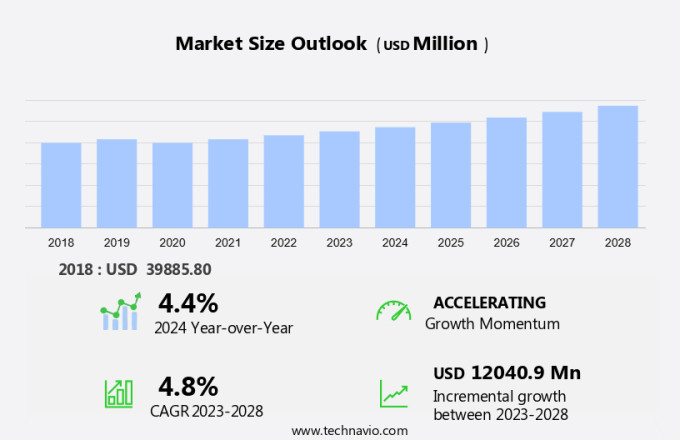

The North America flexible packaging market size is forecast to increase by USD 12.04 billion at a CAGR of 4.8% between 2023 and 2028.

- The market in the personal care sector is witnessing significant growth due to several key trends. The increasing demand for pouch packaging and micro packaging materials is driving market expansion. Consumers prefer lightweight and portable packaging solutions for their personal care products, leading to popularity. Furthermore, the growing trend toward hygiene and sustainability is fueling the adoption made from materials like plastic, paper, and metals. Polypropylene is a preferred material due to its excellent barrier properties and low cost. Recycling initiatives are also gaining momentum, with many companies investing in recycling technologies to reduce the environmental impact of packaging waste. Another trend is the integration of smart packaging solutions, which offer features like real-time inventory management and product freshness indicators, enhancing consumer experience. However, competition from rigid packaging remains a challenge for market growth. Despite this, the market is expected to continue its upward trajectory, driven by the aforementioned trends and the increasing demand for convenient and sustainable packaging solutions in the personal care industry.

What will be the size of the market during the forecast period?

- The flexible packaging market is witnessing significant growth, driven by the increasing demand from various industries, including personal care and consumer goods. Flexible packaging offers numerous advantages over traditional packaging materials such as plastic, paper, metals, glass, and others. Plastic, a prominent material in flexible packaging, is widely used due to its low cost, ease of processing, and excellent barrier properties. However, concerns regarding plastic waste and environmental impact have led to the exploration of alternative materials. Paper and paperboard are gaining popularity in the market due to their renewable and biodegradable nature. These materials are commonly used in stand-up pouches, bags, and films and wraps for various applications, including food and non-food products. Metals, particularly aluminum foil, have been a staple in the packaging industry for decades.

- Moreover, the food industry is a significant contributor to the flexible packaging market. Flexible packaging offers several advantages, including extended shelf life, reduced food wastage, and improved product protection. The use of smart packaging technologies, such as temperature indicators and oxygen scavengers, is also gaining popularity in the food industry to ensure product safety and quality. The consumer goods industry, including electronics, cosmetics, and others, is another major consumer of flexible packaging. These industries require packaging that offers excellent protection, ease of use, and branding opportunities. The use of innovative packaging solutions, such as bag-in-box and tetra packs, is increasing in the consumer goods industry to meet the evolving needs of consumers. Biodegradable films are gaining popularity in the flexible packaging market due to their environmental benefits. These films offer similar properties to traditional plastic films but decompose naturally, reducing waste and minimizing the environmental impact.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Plastic

- Paper

- Foil

- Geography

- North America

- Canada

- Mexico

- US

- North America

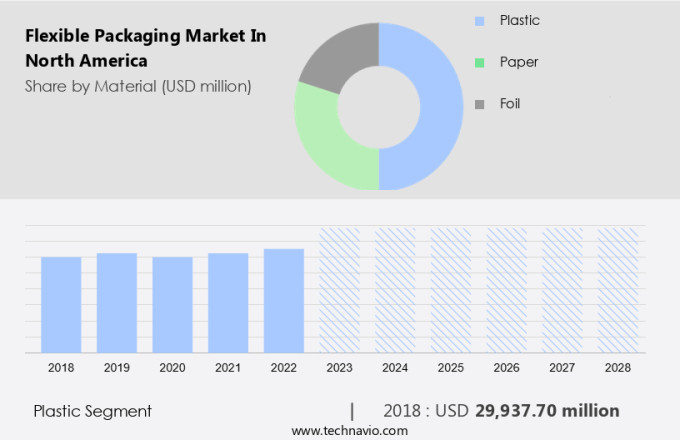

By Material Insights

- The plastic segment is estimated to witness significant growth during the forecast period.

The plastic segment of the North American flexible packaging market holds significant importance, attributed to its versatility, lightweight properties, and cost-effectiveness. Key plastics, including polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), lead this segment due to their high durability, excellent barrier properties, and flexibility in packaging applications. The market expansion in North America is primarily fueled by the increasing demand from industries such as food and beverages, pharmaceuticals, and personal care. In the food sector, flexible plastic packaging offers benefits like extended shelf life, reduced food waste, and enhanced portability. Pharmaceutical applications rely on plastic packaging for secure, tamper-evident, and sterile containment.

Moreover, the personal care industry is increasingly adopting flexible packaging, particularly for hygiene products like diapers, feminine care, and wipes. Smart packaging solutions, such as those incorporating RFID and QR codes, are gaining popularity for inventory management and improved consumer engagement. Lastly, recycling initiatives are playing a crucial role in the growth of the flexible packaging market in North America.

Get a glance at the market share of various segments Request Free Sample

The plastic segment was valued at USD 29.94 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of North America Flexible Packaging Market?

Rising demand for pouch packaging is the key driver of the market.

- The market is witnessing significant growth, with stand-up pouches being a key contributor. These pouches offer numerous benefits, including lightweight properties, ease of use, resealability, and improved shelf appeal, making them popular across various sectors such as consumer goods, electronics, cosmetics, medical supplies, household care, and biodegradable films. In the consumer goods sector, pouches are gaining popularity due to their ability to protect products effectively, preserving freshness, flavors, and nutritional content. Their flexible nature also results in reduced material usage and production costs compared to traditional rigid packaging options like paperboard, bag-in-box, or bottles. Resealable pouches, in particular, cater to consumers' convenience needs, offering portion control and ease of use. This trend is prevalent in industries like food and beverages, where consumers prefer pouches for their versatility and ability to maintain product freshness.

- Moreover, the increasing demand for eco-friendly packaging solutions is driving the adoption of biodegradable films in the flexible packaging market. These films offer sustainability benefits while maintaining the advantages of traditional pouches. In summary, the flexible packaging market in North America is experiencing growth, with stand-up pouches leading the charge due to their versatility, cost-effectiveness, and convenience. These advantages make pouches a preferred choice across various industries, including consumer goods, electronics, cosmetics, medical supplies, household care, and biodegradable films. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the North America Flexible Packaging Market?

Growing demand for micro packaging materials is the upcoming trend in the market.

- The food and beverage sector in North America is witnessing a shift towards sustainable packaging solutions. Micro packaging, a form of innovative and compact packaging, is gaining popularity due to its ability to maintain product freshness during transportation and prolong shelf life. This packaging format includes various options such as flat-bottom bags, pouches/sachets, glass and liquid cartons, and strip packs. Manufacturers use raw materials like cast polypropylene (CPP), BOPP, LDPE, HDPE, PET, coated polypropylenes, polyesters, cast polyamide (CPA), paper, cardboard, and aluminum to produce these micro packaging materials.

- Additionally, advanced features include anti-mist treatment, UV filtration, laminated films for pasteurization, sterilization, and microwave use, and micro-perforation for precise control of air permeability. Near-field communication (NFC) technology is also integrated into micro packaging to provide user-friendly features, such as product information and expiration dates, enhancing the consumer experience. By adopting micro packaging, food and beverage companies can reduce waste, improve logistics, and cater to evolving consumer preferences for sustainable and convenient packaging solutions. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does North America Flexible Packaging Market face during the growth?

Competition from rigid packaging is a key challenge affecting the market growth.

- The market encompasses both rigid and flexible packaging solutions. Rigid packaging includes various types, such as plastic, metal, board, and glass. Conversely, flexible packaging consists of plastic, paper, and foil. The packaging industry caters to the same customer base, primarily comprising food and beverage, pharmaceutical, and consumer goods manufacturers. In the forecasted year 2023, there is a growing emphasis on environmentally friendly packaging and cost-reduction initiatives. End-users are increasingly favoring flexible packaging over rigid alternatives.

- For instance, the transition from bottle-packed items to pouch packaging is gaining traction to minimize waste and save on storage and transportation expenses. Moreover, the adoption of advanced technologies like QR codes in flexible packaging enhances product traceability and consumer engagement. Cartons, Tetra packs, and boxes made from recyclable materials are gaining popularity as eco-conscious packaging solutions. Packaging manufacturers are continuously innovating to cater to this trend, offering sustainable and cost-effective packaging options to their clients. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive North America Flexible Packaging Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- American Packaging Corp.

- Berry Global Inc.

- Bischof Klein SE and Co. KG

- Bryce Corp.

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- Glenroy Inc.

- Hindalco Industries Ltd.

- Huhtamaki Oyj

- Mondi Plc

- Novolex

- Printpack Inc.

- ProAmpac Holdings Inc.

- Sealed Air Corp.

- Sonoco Products Co.

- Tetra Laval SA

- Transcontinental Inc.

- WestRock Co.

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth in various consumer goods sectors such as personal care, food, electronics, cosmetics, medical supplies, and household care. Plastic, paper, and metals are the primary materials used in producing flexible packaging, with polypropylene being a popular choice due to its excellent barrier properties. Recycling plays a crucial role in the flexible packaging industry, with bioplastics and biodegradable films gaining traction due to their environmentally friendly nature. Hygiene and inventory management are essential considerations in the personal care sector, leading to the adoption of smart packaging solutions such as QR codes and near-field communication (NFC) for sales tracking and product tracking.

In conclusion, flexible packaging offers user-friendly features such as stand-up pouches, flat-bottom bags, and bag-in-box designs for various applications. Food industries focus on extending food shelf life and reducing food wastage through advanced barrier properties in films and wraps. The electronics sector benefits from the lightweight and protective nature of pouches and bags. Packaging manufacturers prioritize recyclable products and waste reduction, with paper-based packaging, cartons, tetra packs, and boxes also gaining popularity. Aluminum foil and bioplastics are other materials used in the market. The market also caters to non-food products, including household care and medical supplies, with innovative designs and advanced technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

132 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market Growth 2024-2028 |

USD 12.04 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch