Online Furniture Market Size 2025-2029

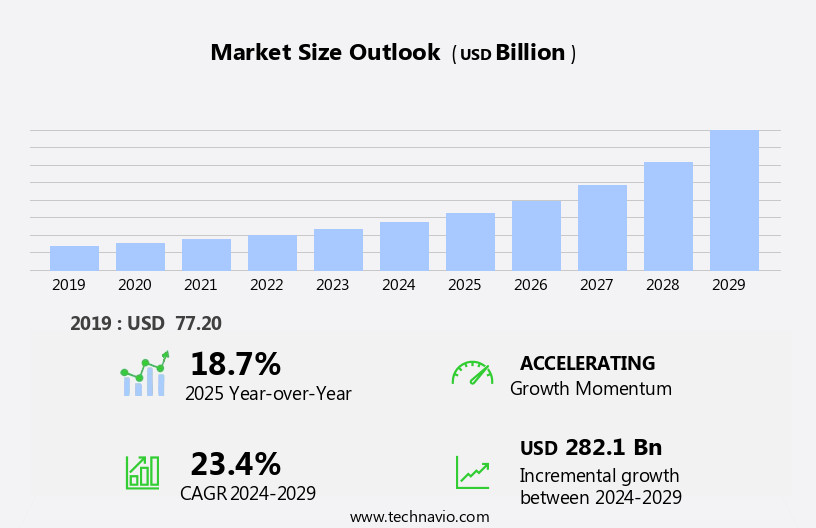

The online furniture market size is forecast to increase by USD 282.1 billion at a CAGR of 23.4% between 2024 and 2029.

- The global online furniture market is expanding, fueled by consumer shifts toward e-commerce and technologies like augmented reality that enrich the shopping experience. This report provides practical insights through comprehensive market size data, growth forecasts, and analysis of key segments such as online residential furniture, which dominates due to its appeal to homeowners seeking variety. It highlights a significant trend in virtual showrooms, transforming how consumers browse, while noting a challenge from fierce vendor competition, which pressures pricing. With regional insights, vendor strategies, and purchasing trends, this report helps businesses sharpen strategies, boost client engagement, and remain competitive in a dynamic global landscape by addressing trends and rivalry.

What will the Size of the Online Furniture Market be During the Forecast Period?

To learn more about the market report, Request Free Sample

- The market has experienced significant growth in recent years, with ecommerce store owners capitalizing on the trend towards convenient and accessible home decor solutions. Dropshipping models have made it easier than ever to enter this market, allowing businesses to offer a wide range of stylish house furnishings and home decoration items without the need for extensive inventory. One key area of innovation in the online furniture space is customization and personalization. Augmented reality technology enables customers to visualize how furniture pieces would look in their homes before making a purchase. Artificial intelligence and 3D visualization tools offer additional ways to enhance the shopping experience, allowing customers to explore different interior designs and renovation trends with ease.

How is the Online Furniture Market Segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- ORF

- OCF

- Product

- Living room furniture

- Bedroom furniture

- Office furniture

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

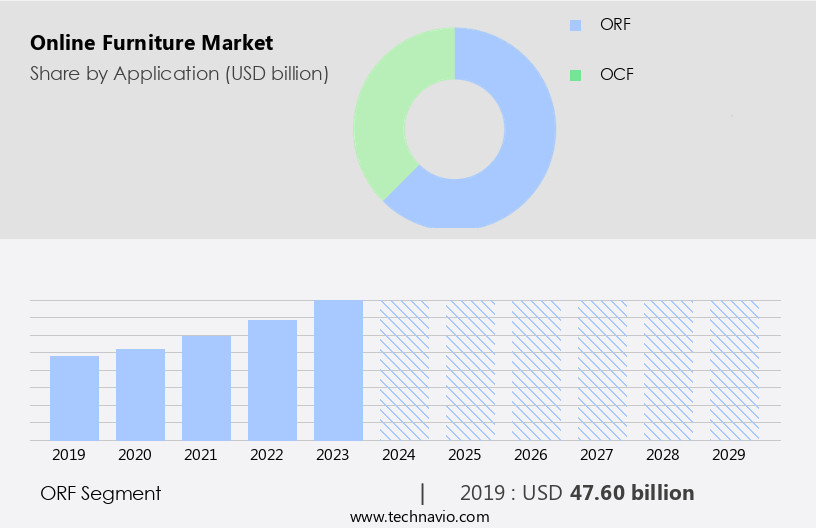

By Application Insights

The ORF segment is estimated to witness significant growth during the forecast period.The market experienced significant growth in 2024, with the ORF segment holding the largest market share. Factors such as increasing disposable income, population growth, and rising online penetration in countries like China and India are driving this expansion. Multifunctional furniture and the demand for luxury home furnishings are also contributing to market growth. Living room furniture, including recliner sofas, tables, chairs, and decorative pieces, is a key category, with sales expected to increase during the forecast period. Wayfair, a prominent US-based online retailer, offers a wide selection of living room furniture in various styles and price points, making it a convenient option for consumers and reducing the need to visit physical stores.

Get a glance at the market report of share of various segments. Request Free Sample

The ORF segment was valued at USD 47.60 billion in 2019 and showed a gradual increase during the forecast period.

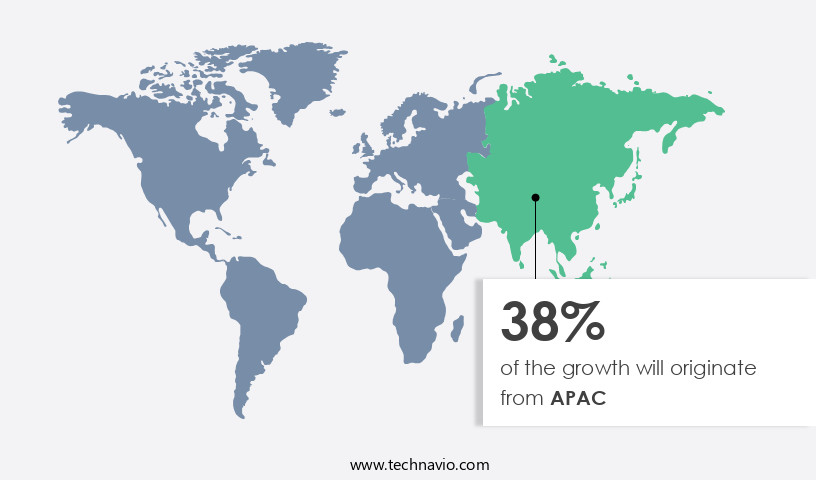

Regional Analysis

APAC is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth, with China being the leading market in the region in 2024. Factors driving this growth include the expanding real estate sector for both residential and commercial properties, as well as increasing urbanization and rising disposable income. With the two largest populations in the world, APAC's demand for real estate is increasing, leading to a wave in the market. The market is experiencing notable expansion due to the rising trends in gardening and the increasing preference for high-end products, such as glass, metal, and wooden furniture. Additionally, digitalization and the development of economies are encouraging consumers in the region to invest in luxury furniture. The rise of the internet and improving connectivity have also made online furniture shopping more accessible and convenient for consumers in APAC.

Online Furniture Market Dynamics

Sustainability is also a major focus in the market. Consumers are increasingly seeking out sustainable materials, such as rattan and bamboo, and recycled textiles. Formaldehyde-based items have fallen out of favor due to health concerns, making way for more eco-friendly alternatives. Digital marketing plays a crucial role in the success of online furniture businesses. Promotional campaigns, discounts, and coupons are effective ways to attract and retain customers. Luxurious products catering to specific markets, such as pc gaming trends and their accompanying gaming tables, also offer opportunities for growth. In summary, the market is a dynamic and innovative space, driven by trends towards convenience, customization, sustainability, and digital marketing.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Online Furniture Market?

- Increasing online spending and smartphone penetration is the key driver of the market.The market has experienced significant growth due to the increasing penetration of the internet and the convenience of shopping from home. Online shopping through devices like tablets has become popular as they offer larger interfaces and facilitate easier decision-making. Ecommerce stores provide detailed product information, safety measures, and user guidance, making consumers feel more comfortable with their purchases. Dropshipping models have also gained traction, allowing ecommerce store owners to offer a wide range of home furnishings without holding inventory. Technology plays a crucial role in the market with the use of augmented reality and artificial intelligence for customization and personalization.

- Sustainable materials such as rattan, bamboo, and recycled textiles are gaining popularity among consumers. The market caters to various segments including living spaces, offices, and outdoor areas. Digital marketing strategies, promotional campaigns, and discounts are common tactics used by prominent retailers to attract consumers. The middle class population and demand for stylish house furnishings, home decoration, and renovation trends continue to fuel the growth of the market. The wood, metal, plastic, glass, indoor, and outdoor segments cater to residential, office, hotel, educational institutes, public gardens, theaters, and other commercial spaces. Despite the challenges of customs and import, and raw material prices, the market remains consistent in its implementation of e-retailing solutions.

What are the market trends shaping the Online Furniture Market?

- Mobile commerce and network marketing is the upcoming trend in the market.The market in the US is experiencing significant growth due to the integration of technology in home furnishings shopping. Ecommerce store owners are capitalizing on this trend by offering dropshipping services, enabling consumers to purchase home furniture and decoration items from various online stores without the need for physical inventory. Customization and personalization are key features of this market, with augmented reality and artificial intelligence technology allowing customers to visualize how stylish house furnishings would look in their living spaces before making a purchase. Digital marketing strategies, such as prominent promotional campaigns, discounts, and coupons, are driving sales for sustainable furniture made from materials like rattan, bamboo, and recycled textiles.

- Consumers are increasingly seeking eco-friendly and sustainable options due to renovation trends and concerns over formaldehyde-based items causing skin irritation. The market dynamics include the middle class population's growing demand for luxurious products, fluctuating raw material prices, customs and import regulations, and the increasing popularity of remote working leading to the need for work tables and chairs. The wood, metal, plastic, glass, indoor, outdoor, residential, office, hotel, educational institutes, public gardens, theaters, and PC gaming segments are all experiencing growth in this market. Online shopping for furniture and home decoration continues to gain momentum, with consumers able to browse and purchase sofas, stools, chairs, and other home essentials from the comfort of their homes.

What challenges does Online Furniture Market face during the growth?

- The longer replacement cycle of products is a key challenge affecting the market growth.The market in the US is experiencing steady growth due to the increasing popularity of e-commerce and dropshipping among ecommerce store owners. Home furniture, including sofas, stools, chairs, and sectional sofas for living spaces, dining rooms, offices, and outdoor areas, are in high demand for personalization and customization. Technology plays a significant role in this market, with augmented reality and artificial intelligence enabling 3D visualization tools for consumers to preview their potential purchases. Digital marketing strategies, such as prominent retailers' promotional campaigns, discounts, and coupons, also attract a large consumer base. Sustainable materials, such as rattan, bamboo, and recycled textiles, are gaining popularity due to consumer concerns about formaldehyde-based items and skin irritation.

- Renovation trends, including planting, gardening, and creating anchoring points with cubicles, are also influencing the market. The middle class population's increasing disposable income and the availability of luxurious products cater to various segments, including residential, office, hotel, educational institutes, public gardens, theaters, and PC gaming trends. Raw material prices, customs and import regulations, and the various segments, including wood, metal, plastic, glass, indoor, and outdoor, impact the market dynamics. Despite these challenges, the market continues to expand, offering consumers a convenient and stylish way to furnish their living spaces and decorate their homes.

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market growth analysis report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Online Furniture Market Companies

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Ashley Global Retail LLC - The company offers furniture online, such as bedroom furniture and living room furniture.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc

- Bassett Furniture Industries Inc.

- Bobs Discount Furniture LLC

- Flipkart Internet Pvt. Ltd.

- Haverty Furniture Companies Inc.

- Hindware Home Innovation Ltd.

- HNI Corp.

- HSN Inc.

- Inter IKEA Holding B.V.

- LaZBoy Inc.

- MillerKnoll Inc.

- Otto GmbH and Co. KG

- Pepperfry Pvt. Ltd.

- Pier 1 Imports Online Inc.

- Raymour and Flanigan Furniture and Mattresses

- Steelcase Inc.

- Urban Ladder Home Decor Solutions Pvt. Ltd.

- Wayfair Inc.

- Williams Sonoma Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In December 2024, Wayfair launched a new virtual reality (VR) tool on its website, allowing customers to visualize furniture in their homes before making a purchase. This feature is designed to enhance the online shopping experience and reduce the uncertainty of buying furniture without seeing it in person.

-

In November 2024, IKEA expanded its online furniture offerings with a new customization feature. Customers can now design and order personalized furniture pieces, such as sofas and storage units, with various fabric, color, and size options, aiming to meet the growing demand for unique, made-to-order home decor.

-

In October 2024, Overstock introduced a new subscription service that offers exclusive discounts and early access to sales on a wide range of furniture items. This service aims to attract loyal customers and enhance the online shopping experience with added value for repeat buyers.

-

In September 2024, Amazon entered the online furniture market with a new line of exclusive home furniture brands. These products range from living room furniture to bedroom essentials, with a focus on affordability and convenience, catering to consumers seeking quick, reliable delivery for their home furnishings.

Research Analyst Overview

The market has experienced remarkable growth in recent years, transforming the way consumers shop for home furnishings and decor. This dynamic industry is shaped by various trends, technologies, and consumer preferences that continue to evolve. Online shopping has become the go-to choice for many e-commerce store owners, offering convenience, affordability, and an extensive selection of home furniture and decorative items. The rise of dropshipping has further facilitated this trend, enabling businesses to operate with minimal inventory and reduced overhead costs. Customization and personalization are key factors driving the market. Consumers increasingly seek unique, stylish house furnishings that reflect their personal taste and living space requirements. Augmented reality and artificial intelligence technologies are increasingly being employed to help consumers visualize how furniture pieces will look in their homes before making a purchase.

Moreover, technology plays a significant role in the market. 3D visualization tools enable customers to explore product designs in detail, while digital marketing strategies help retailers reach a wider audience. Sustainable materials, such as rattan, bamboo, recycled textiles, and eco-friendly upholstery, are gaining popularity among consumers concerned about reducing their carbon footprint and minimizing skin irritation caused by formaldehyde-based items. Renovation trends, including remote working and the need for ergonomic workspaces, have led to increased demand for work tables, chairs, and office furniture. The indoor segment, which includes sofas, stools, and chairs for various rooms like halls, dining rooms, and offices, continues to dominate the market. The outdoor segment, featuring patio tables, garden chairs, and other home decor, is also growing rapidly, as consumers focus on creating inviting living spaces that extend beyond the interior of their homes. The residential segment remains the largest market, but the office, hotel, educational institutes, public gardens, and theaters segments are also significant contributors.

Further, market dynamics are influenced by various factors, including raw material prices, customs and import regulations, and consumer preferences. The wood, metal, plastic, and glass segments each present unique opportunities and challenges. For instance, the wood segment is subject to fluctuations in raw material prices, while the metal segment faces increasing competition from alternative materials. Prominent retailers are responding to these trends by implementing consistent promotional campaigns, offering discounts, and using coupons to attract and retain customers. The middle class population, a key demographic, is increasingly drawn to luxurious, high-quality products that offer value for money. In conclusion, the market is a vibrant, ever-evolving landscape shaped by consumer preferences, technological advancements, and market dynamics.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.4% |

|

Market growth 2025-2029 |

USD 282.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

18.7 |

|

Key countries |

US, China, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch