Reusable Icepacks Market Size 2025-2029

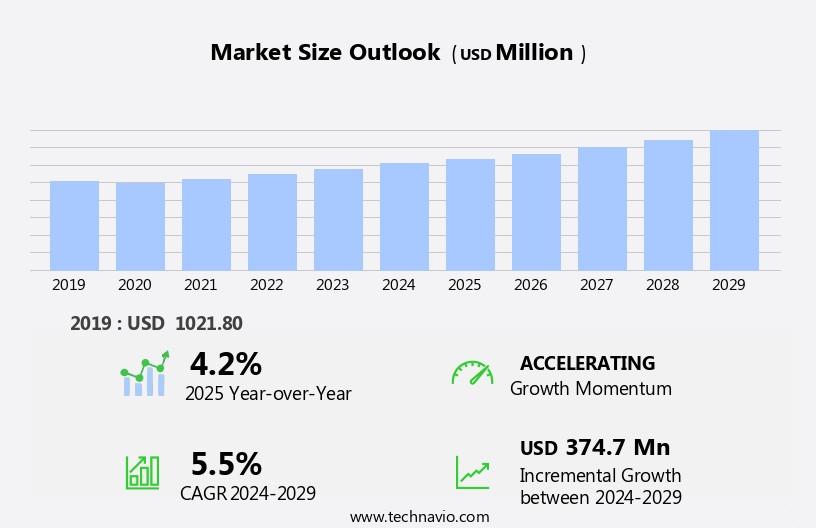

The reusable icepacks market size is forecast to increase by USD 374.7 million, at a CAGR of 5.5% between 2024 and 2029. The market is experiencing significant growth due to the increasing demand for packaged food and beverages.

Major Market Trends & Insights

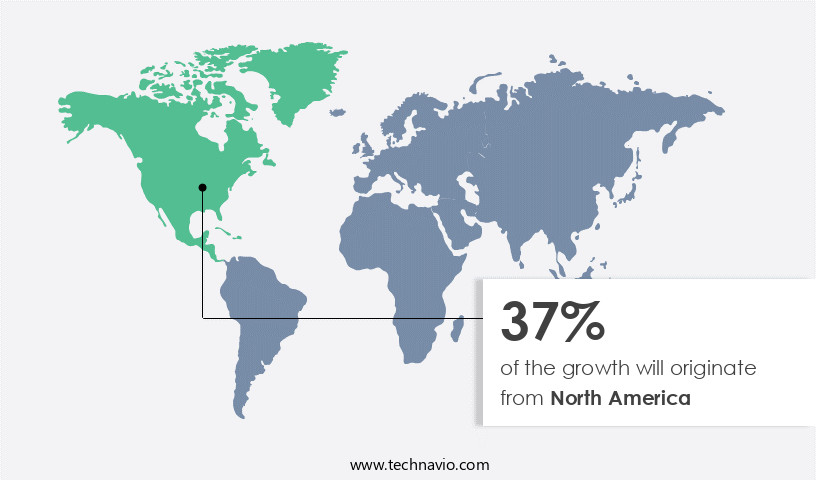

- North America dominated the market and accounted for a 37% share in 2023.

- The market is expected to grow significantly in APAC region as well over the forecast period.

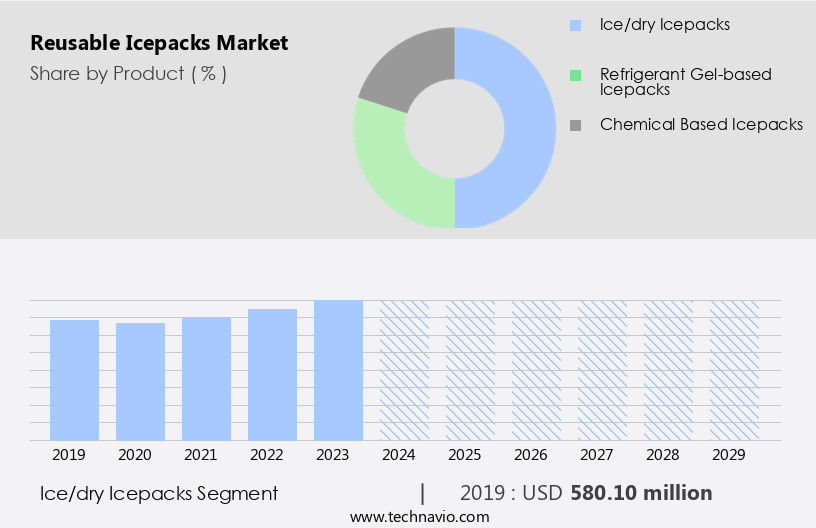

- Based on the Product, the ice/dry icepacks segment led the market and was valued at USD 671.70 million of the global revenue in 2023.

- Based on the Application, the food and beverage segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 1.21 Billion

- Future Opportunities: USD 374.7 Million

- CAGR (2024-2029): 5.5%

- North America: Largest market in 2023

The reusable ice pack market continues to evolve, driven by advancements in technology and increasing demand across various sectors. Gel pack technology, utilizing non-toxic coolant, has gained significant traction due to its superior thermal conductivity and phase change material properties. Sterilization methods have been refined to ensure the highest level of hygiene and safety, particularly in medical applications. One notable example of market growth is in the field of blood transport. Reusable ice packs have been instrumental in optimizing cold chain logistics, enabling efficient temperature regulation and reducing the environmental impact of disposable ice packs. According to industry reports, the market is projected to grow by over 5% annually, driven by the demand for energy-efficient, customizable insulated packaging solutions.

What will be the Size of the Reusable Icepacks Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In the sports injury sector, Flexible Packaging and remote temperature monitoring have become essential features, enhancing the convenience and effectiveness of reusable ice packs. Manufacturers have also focused on improving the durability and lifespan of these products through rigorous durability testing and supply chain integration. Vaccine storage and pharmaceutical transport are other key applications, requiring stringent temperature monitoring and cold storage optimization. Re-freezable ice packs have emerged as a preferred choice due to their high freezer pack efficiency and ability to maintain consistent temperatures. Moreover, the ongoing focus on reducing the environmental impact of packaging has led to the development of eco-friendly materials and manufacturing processes. The refrigerant gel-based icepacks segment is the second largest segment of the product and was valued at USD 399.50 million in 2023.

The integration of data logging and leakage prevention technologies has further enhanced the appeal of reusable ice packs in the market. With the rapid industrialization and economic growth in emerging markets, there is a surging need for efficient and effective cold chain solutions. Reusable icepacks offer a sustainable and cost-effective alternative to traditional ice packs, making them an attractive option for businesses seeking to minimize waste and reduce logistics costs. However, the market also faces challenges. Safe handling and transportation of dry ice, a common component in reusable icepacks, pose significant hurdles. The potential hazards associated with dry ice, such as frostbite and asphyxiation, necessitate stringent safety protocols and specialized training for handling and transportation.

Companies must invest in proper safety measures and adhere to regulatory guidelines to mitigate risks and ensure the safe and efficient use of reusable icepacks. By addressing these challenges, market participants can capitalize on the growing demand for sustainable cold chain solutions and position themselves as leaders in the market.

How is this Reusable Icepacks Industry segmented?

The reusable icepacks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Ice/dry icepacks

- Refrigerant gel-based icepacks

- Chemical based icepacks

- Application

- Food and beverage

- Medical and healthcare

- Chemicals

- Distribution Channel

- Retail Stores

- Pharmacies

- Mail Order Pharmacy

- Online Stores

- Material Type

- Polyethylene

- Nylon

- Vinyl

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The ice/dry icepacks segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 671.70 million in 2023. It continued to the largest segment at a CAGR of 6.21%.

Reusable ice packs, a crucial component of cold chain logistics, have gained significant traction in various industries due to their efficiency and sustainability. These packs utilize advanced gel technology, which employs non-toxic coolants and phase change materials for temperature regulation. Sterilization methods ensure safety and hygiene, while lifecycle assessments minimize environmental impact. In medical applications, ice packs facilitate temperature monitoring and optimization in cold storage, crucial for vaccine and blood transport. The manufacturing process involves material selection for durability and energy efficiency, with flexible packaging ensuring customizable sizes. Heat transfer rates are optimized for temperature regulation, and remote temperature monitoring enables real-time data logging.

Leakage prevention is ensured through robust manufacturing processes, and insulated packaging maintains the desired temperature. Reusable ice packs are re-freezable, offering cost savings and reducing waste in bulk packaging. For instance, a leading pharmaceutical company reported a 20% increase in the efficiency of their cold chain logistics by implementing reusable ice packs. The market for these packs is expected to grow by 15% annually, driven by the increasing demand for temperature-sensitive goods and the need for reliable, sustainable cooling solutions.

The Ice/dry icepacks segment was valued at USD 580.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The reusable ice pack market in the US is projected to expand significantly due to increasing demand from the food and beverage sector. Data suggests that the future opportunities for growth in the North America region estimates to be around USD 374.7 million. These ice packs are essential for maintaining the temperature of perishable food items such as fruits, vegetables, meat, seafood, and bakery products during transportation and storage. According to recent data, fresh foods account for over 32% of the food, groceries, and personal care expenses of US consumers. The domestic production of fruits and vegetables and meat in the US is high, leading to a steady rise in demand for fresh food. Moreover, health-conscious consumers are shifting from processed, packaged food to fresh food, further fueling market growth.

Reusable ice packs are designed using advanced technologies like gel pack technology, non-toxic coolant, and phase change material to ensure optimal temperature regulation and energy efficiency. Sterilization methods are employed during the manufacturing process to ensure the hygiene and safety of the ice packs. Material selection and insulated packaging are crucial factors in maintaining the required thermal conductivity and cold storage optimization. In addition to food applications, reusable ice packs find extensive use in medical applications, particularly in blood transport, vaccine storage, and sports injury treatment. These ice packs are customizable in sizes, making them suitable for various applications. Remote temperature monitoring and data logging are essential features that enable effective temperature monitoring and cold chain logistics.

The market for reusable ice packs is expected to grow at a substantial rate due to the increasing demand for temperature-controlled packaging solutions. For instance, the pharmaceutical industry requires temperature-controlled packaging for the transportation and storage of vaccines and other temperature-sensitive pharmaceutical products. The use of reusable ice packs in this sector can help reduce the environmental impact and improve energy efficiency compared to disposable ice packs. Furthermore, the manufacturing process of reusable ice packs involves leakage prevention measures to ensure safety and durability. The use of flexible packaging and heat transfer rate optimization helps in reducing the overall weight and size of the ice packs, making them more convenient for consumers.

Additionally, the integration of the supply chain can help in reducing costs and improving efficiency. In conclusion, the reusable ice pack market in the US is poised for significant growth due to the increasing demand for temperature-controlled packaging solutions in the food and beverage and medical sectors. The use of advanced technologies and materials, energy efficiency, and environmental sustainability are key trends driving market growth. According to industry estimates, the market for reusable ice packs is expected to grow by over 15% annually during the forecast period.

Market Dynamics

"The reusable icepacks market is driven by rising demand for eco-friendly cooling solutions, with Asia-Pacific leading due to its growing eco-conscious consumer base and expanding healthcare sector."

- Rahul Somnath, Assistant Research Manager, Technavio

In the reusable ice packs market, advancements focus on reusable ice pack manufacturing process optimization to enhance efficiency and reduce costs. Key considerations include phase change material selection for reusable ice packs, ensuring optimal performance across applications. The impact of packaging design on reusable ice pack performance is critical, alongside temperature monitoring systems for reusable ice packs to maintain reliability. Lifecycle assessment of reusable ice pack materials guides sustainable practices, while reusable ice pack design for efficient cold chain logistics improves logistics. Improving the durability of reusable ice packs and cost-effective manufacturing of reusable ice packs drive market growth.

Sustainable materials for reusable ice pack production align with safety and regulatory compliance of reusable ice packs. Reusable ice pack applications in pharmaceutical transport benefit from reusable ice pack performance in different climates and optimal design for reusable ice pack cooling capacity. Comparing different pcms for reusable ice pack applications aids in minimizing environmental impact of reusable ice packs. The role of insulation in reusable ice pack efficiency, reusable ice packs for vaccine storage and transportation, leak prevention techniques for reusable ice pack designs, designing reusable ice packs for specific medical applications, and reusable ice pack performance testing and validation further solidify industry standards.

What are the key market drivers leading to the rise in the adoption of Reusable Icepacks Industry?

- The significant surge in consumer preference for convenient, ready-to-consume food and beverage options is the primary market driver, fueling the growth of the packaged food and beverages industry.

- Reusable icepacks have gained significant traction in the food and beverage industry due to their ability to enhance product durability and extend shelf life. These icepacks offer numerous benefits, including resistance to heat, humidity, and gas, as well as an aroma barrier. With their puncture-resistant and high tensile strength properties, reusable icepacks ensure the safety and integrity of perishable goods. Moreover, their chemical resistance and weight reduction properties make them an attractive alternative to traditional packaging materials. The food and beverage sector's increasing demand for sustainable packaging solutions has fueled the growth of the reusable icepack market. According to industry reports, the market is expected to expand at a robust rate in the coming years.

- For instance, the use of reusable icepacks in the transportation of temperature-sensitive food products has resulted in a 20% reduction in spoilage rates for one major food manufacturer. This not only saves costs but also reduces food waste and contributes to a more sustainable Food Supply Chain.

What are the market trends shaping the Reusable Icepacks Industry?

- The trend in the global economy involves rapid industrialization and robust growth in emerging markets.

- The market is experiencing a surge in emerging economies, including China, India, Brazil, South Africa, and Indonesia. China is anticipated to lead the global market due to the substantial demand from sectors like food and beverage and medical and healthcare. The food and beverage industry, along with fast-moving consumer goods (FMCG), is fueling the demand for reusable icepacks in food packaging.

- This growth can be attributed to the rising disposable incomes and increasing economic activities in these markets. The market is expected to exhibit a robust growth rate in the coming years, driven by the increasing awareness of sustainable packaging solutions and the growing preference for eco-friendly products.

What challenges does the Reusable Icepacks Industry face during its growth?

- The safe handling and transportation of dry ice poses a significant challenge that can impact the growth of the industry. Ensuring proper handling techniques and secure transportation methods are essential to mitigate potential risks associated with dry ice, such as cold burns, asphyxiation, and potential damage to goods or infrastructure. Adhering to industry standards and utilizing specialized equipment can help minimize these risks and contribute to the industry's continued expansion.

- The Reusable Ice Packs market is driven by the need for safe and efficient transportation of temperature-sensitive goods, particularly those requiring the use of dry ice. Dry ice, a solid form of carbon dioxide, poses hazards during transportation due to its ability to change to a gaseous state and displace oxygen. Consequently, regulatory requirements, such as 49 CFR 172.700, mandate specialized training for transporters in handling dangerous goods. Moreover, the increasing demand for perishable goods and the growing trend towards sustainable packaging solutions are expected to fuel market growth. For instance, reusable ice packs offer a more eco-friendly alternative to disposable ice packs and can reduce the need for frequent dry ice shipments.

- According to industry reports, the Reusable Ice Packs market is projected to grow at a significant rate, with an estimated 20% of the global temperature-controlled packaging market expected to adopt reusable ice packs by 2025. This growth is attributed to the advantages offered by reusable ice packs, such as their durability, cost-effectiveness, and environmental sustainability.

Exclusive Customer Landscape

The reusable icepacks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the reusable icepacks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, reusable icepacks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Accurate Manufacturing Inc.

- Arctic Ice LLC

- Bent Grass Concepts

- Bunzl Plc

- Cardinal Health Inc.

- CFS Brands LLC

- Cold Chain Technologies

- Cryopak

- Dometic Group AB

- Global National Australia Pty Ltd.

- GVS International

- Insulated Products Corp.

- King Brand Healthcare Products Ltd.

- Meglio

- Navagen Products Pvt. Ltd.

- Temperatsure LLC

- Pitreavie Group

- Thermos LLC

- Tourit

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Reusable Icepacks Market

- In January 2024, ThermoSafe, a leading provider of temperature-controlled packaging solutions, announced the launch of their new line of reusable icepacks, named "ChillGuard." These icepacks, designed with advanced phase change material technology, offer superior temperature control and longer durability than traditional icepacks (ThermoSafe Press Release, 2024).

- In March 2024, Cold Chain Technologies, a prominent player in the reusable icepack market, entered into a strategic partnership with DHL Supply Chain. This collaboration aimed to enhance DHL's cold chain logistics capabilities, providing improved temperature-controlled solutions for their clients (DHL Press Release, 2024).

- In May 2024, Cryopak, a global leader in temperature-controlled packaging, secured a significant investment of USD20 million from Quad-C Management, a leading private equity firm. The funds were earmarked for expanding Cryopak's production capacity and research and development efforts, including the development of advanced reusable icepacks (Cryopak Press Release, 2024).

- In February 2025, the European Commission approved the use of reusable icepacks in air cargo transportation, marking a significant policy change. This approval is expected to boost the adoption of reusable icepacks in the European air cargo market, reducing the environmental impact of single-use icepacks (European Commission Press Release, 2025).

Research Analyst Overview

- The reusable icepack market continues to evolve, driven by the growing demand for sustainable packaging solutions and the increasing importance of temperature control in various sectors. These include healthcare, food and beverage, and industrial applications. According to industry reports, the market is expected to grow by over 5% annually, with a focus on enhancing product performance and design. For instance, a leading manufacturer has reported a 20% increase in sales due to the introduction of a new reusable icepack design, featuring improved cooling capacity and dimensional stability. The product's chemical inertness ensures safe and effective temperature control throughout the reuse cycle, while its recyclable materials align with the industry's push towards sustainable packaging.

- In addition, advancements in sealing technology and leak test methods have led to increased thermal stability, enabling longer shelf life and reducing thawing time. The integration of safety protocols and regulatory compliance in the manufacturing process further ensures the quality of these products. Moreover, the market's focus on logistics optimization and cold chain management has led to the development of efficient delivery systems and maintenance procedures, ensuring optimal performance metrics and user instructions. These efforts have contributed to the ongoing evolution of the reusable icepack market, making it an essential component of temperature control solutions across various industries.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Reusable Icepacks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 374.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, Germany, Japan, Canada, India, UK, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Reusable Icepacks Market Research and Growth Report?

- CAGR of the Reusable Icepacks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the reusable icepacks market growth of industry companies

We can help! Our analysts can customize this reusable icepacks market research report to meet your requirements.