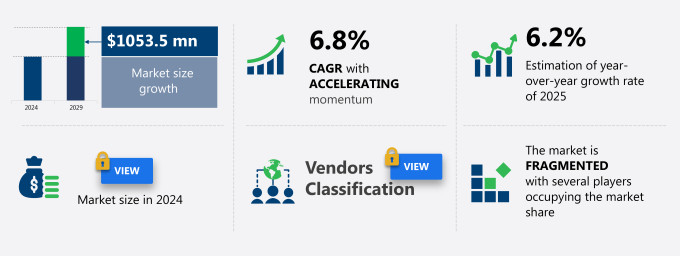

Saudi Arabia Managed Services Market Size 2025-2029

The Saudi Arabia managed services market size is valued to increase USD 1.05 billion, at a CAGR of 6.8% from 2024 to 2029. Rising demand for outsourcing in BFSI and retail sectors will drive the Saudi Arabia managed services market.

Major Market Trends & Insights

- By Type - MDS segment was valued at USD 689.70 billion in 2022

- By Deployment - Cloud segment accounted for the largest market revenue share in 2022

- CAGR : 6.8%

Market Summary

- The market is witnessing significant growth, driven by the increasing adoption of advanced technologies and the rising demand for outsourcing in key sectors such as BFSI and retail. According to recent reports, the cloud-based managed services segment is experiencing a surge in demand, with over 60% of Saudi Arabian businesses now utilizing cloud solutions. However, the market's evolution is not without challenges. Data and privacy concerns remain a major hurdle, with stringent regulations, such as the Saudi Data Protection Law, placing heightened emphasis on data security.

- Despite these challenges, opportunities abound, with the market expected to continue its expansion, fueled by the ongoing digital transformation and the increasing adoption of IoT and AI technologies.

What will be the Size of the Saudi Arabia Managed Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

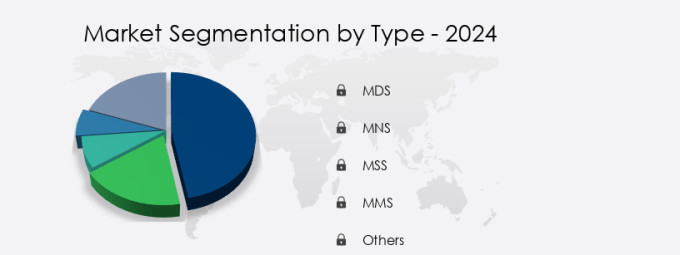

How is the Managed Services in Saudi Arabia Market Segmented and what are the key trends of market segmentation?

The managed services in Saudi Arabia industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- MDS

- MNS

- MSS

- MMS

- Others

- Deployment

- Cloud

- On premises

- End-user

- Government

- Financial services

- Healthcare

- Oil and gas

- Others

- Geography

By Type Insights

The MDS segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving landscape of managed services in Saudi Arabia, Managed Document Services (MDS) have emerged as a vital component. MDS encompasses the management of a company's document infrastructure and processes to boost efficiency, decrease operational expenses, and enhance security. By outsourcing MDS, businesses enable experts to handle their document automation, reproduction, and management requirements, enabling them to concentrate on their core competencies. One substantial advantage of MDS is the potential for significant cost savings. Managed Print Services (MPS) facilitate the optimization of printers, copiers, scanners, and other document-related equipment, leading to substantial cost reductions.

Moreover, the implementation of document management systems and process automation contributes to a decrease in print and paper waste, as well as an increase in document workflow efficiency. Hybrid cloud management plays a crucial role in MDS, ensuring seamless integration of on-premises and cloud-based document systems. Knowledge bases and IT service management tools, such as ITIL framework and ITSM tools, are employed to maintain and manage these systems effectively. Multi-cloud management and service level agreements are essential for organizations to effectively manage their document infrastructure across various cloud environments. Business continuity planning is another critical aspect of MDS, with service catalogs, compliance audits, and disaster recovery services ensuring data protection and business resilience.

Cybersecurity threat intelligence, managed security services, and endpoint detection response are integral to safeguarding document infrastructure from cyber threats. Automation tools, including problem management, change management, and help desk support, streamline document processes and improve overall efficiency. System integration services and network operations centers facilitate the seamless integration of document systems with other business applications. Application performance monitoring, capacity planning, and remote infrastructure management are essential for maintaining optimal document system performance. Monitoring dashboards provide real-time insights into document infrastructure health and performance, enabling proactive issue resolution and continuous improvement. In the future, the market is expected to grow substantially, with an estimated 25% of businesses planning to adopt managed services by 2025.

Furthermore, the increasing adoption of cloud services, the growing importance of IT consulting services, and the rising demand for IT infrastructure outsourcing are expected to fuel market growth. In conclusion, Managed Document Services represent a significant opportunity for businesses in Saudi Arabia to optimize their document infrastructure, reduce operational costs, and enhance security. By leveraging the latest technologies and best practices, organizations can effectively manage their document processes and focus on their core competencies.

The MDS segment was valued at USD 689.70 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth, driven by the increasing demand for proactive managed security services and comprehensive remote infrastructure management solutions. Businesses in Saudi Arabia are prioritizing advanced application performance monitoring techniques to ensure seamless digital transformation and maintain optimal system functionality. Robust disaster recovery service level agreements are also becoming a critical requirement for organizations, given the potential risks of data loss and downtime. Moreover, the adoption of ITIL-based service management processes and cost-effective cloud service provider selection are key trends in the market. The demand for secure data backup and recovery strategies, scalable virtual desktop infrastructure deployments, and automated system performance optimization tools is on the rise.

Hybrid cloud management best practices are gaining traction, with organizations seeking to leverage the benefits of both private and public clouds. Effective cybersecurity threat intelligence gathering and seamless multi-cloud management platforms are essential for businesses operating in the Saudi Arabian market. A comprehensive IT asset management framework and streamlined IT service management workflow are also crucial for organizations to maintain an efficient and cost-effective IT infrastructure. According to market intelligence, more than 70% of Saudi Arabian businesses are opting for reliable IT infrastructure outsourcing options to focus on their core competencies. Sophisticated data loss prevention methodologies and cutting-edge identity and access management solutions are becoming increasingly popular, as organizations prioritize security and compliance.

Enhanced system integration services offerings are also in high demand, as businesses seek to optimize their technology investments and improve operational efficiency. In comparison to other markets in the region, the Saudi Arabian managed services market is experiencing a significantly larger adoption rate of advanced IT solutions, with a growing number of businesses prioritizing digital transformation and IT modernization initiatives. This trend is expected to continue, driven by the increasing demand for agile, flexible, and secure IT services.

What are the key market drivers leading to the rise in the adoption of Managed Services in Saudi Arabia Industry?

- The surge in outsourcing requirements, particularly in the banking, financial services, and insurance (BFSI) and retail sectors, serves as the primary market driver.

- In the Business, Finance, Services, and Insurance (BFSI) sector, there is a growing trend towards outsourcing IT operations. Banks and financial institutions are delegating tasks such as data management, software development, and customer support to external service providers. This shift enables these organizations to concentrate on their primary functions, like investments, risk management, and regulatory compliance. For example, Saudi British Bank (SABB) outsourced its IT infrastructure management services to IBM. This strategic move has allowed SABB to enhance customer service while reducing IT infrastructure management costs.

- Similarly, retail companies are outsourcing non-core functions, including inventory management, logistics, and supply chain management. This outsourcing trend is a continuous process, with businesses seeking to optimize their operations and improve efficiency. The BFSI sector's adoption of outsourcing is a significant development, reflecting the industry's evolving landscape and the increasing importance of operational agility and cost savings.

What are the market trends shaping the Managed Services in Saudi Arabia Industry?

- The adoption of cloud-based managed services is experiencing significant growth in Saudi Arabia, representing the latest market trend.

- In Saudi Arabia, the adoption of cloud-based managed services has seen significant growth over the past few years. This trend is driven by the benefits cloud solutions provide, including scalability, flexibility, and cost savings. The need for digital transformation in various industries is a primary factor fueling this trend. Companies recognize the importance of adapting to technological advancements to maintain competitiveness. The shift to cloud-based services was further accelerated by the COVID-19 pandemic, enabling businesses to facilitate remote work. Industries across Saudi Arabia have embraced cloud solutions to streamline operations, improve efficiency, and enhance collaboration. For instance, the healthcare sector has adopted cloud-based electronic health records to manage patient data more effectively.

- Similarly, the financial services industry has turned to cloud-based platforms for secure data storage and processing. Moreover, cloud services offer the advantage of seamless integration with other business applications, allowing for a more cohesive and efficient business environment. As a result, the adoption of cloud-based managed services is expected to continue, with more businesses recognizing the potential benefits. The shift to cloud-based services represents a significant change in the way businesses operate, offering numerous advantages and transforming the way industries function. By embracing cloud solutions, companies in Saudi Arabia are positioning themselves to remain competitive in the ever-evolving business landscape.

What challenges does the Managed Services in Saudi Arabia Industry face during its growth?

- Data privacy and security concerns represent a significant challenge to the expansion of various industries. These issues, which involve safeguarding sensitive information and protecting individual privacy, can impede growth if not addressed effectively and in compliance with relevant regulations.

- Managed services have gained significant traction in Saudi Arabia's business landscape, with an increasing number of companies outsourcing their IT infrastructure and support functions. This trend is driven by various factors, including cost savings, improved operational efficiency, and access to specialized expertise. However, the adoption of managed services comes with its challenges, particularly concerning data and privacy. According to recent studies, the global data breach cost reached an average of USD 3.86 million per incident in 2020. In the context of managed services, data breaches can occur due to insufficient security measures, a lack of proper vetting of service providers, or human error.

- These incidents can result in substantial financial losses, reputational damage, and legal action. To mitigate these risks, businesses must ensure that their managed service providers have robust security protocols in place. This includes encryption of data both in transit and at rest, regular security audits, and stringent access controls. Additionally, businesses should conduct thorough due diligence on potential service providers, including background checks and verification of certifications and accreditations. By taking these steps, businesses can reap the benefits of managed services while minimizing the risks associated with data and privacy concerns.

Exclusive Customer Landscape

The Saudi Arabia managed services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the Saudi Arabia managed services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Managed Services in Saudi Arabia Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, Saudi Arabia managed services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACS Services Inc. - This company specializes in managed IT services, delivering expertise in server administration, cloud-backed data protection, cybersecurity, disaster recovery, and round-the-clock help desk support.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACS Services Inc.

- Amazon.com Inc.

- AO Kaspersky Lab

- Atos SE

- Cisco Systems Inc.

- Diyar United Co.

- eHosting DataFort

- Fortinet Inc.

- Fujitsu Ltd.

- Google LLC

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- Juniper Networks Inc.

- Microsoft Corp.

- Nokia Corp.

- Palo Alto Networks Inc.

- Security Matterz

- Telefonaktiebolaget LM Ericsson

- Wipro Ltd.

- Zoho Corp. Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Managed Services Market In Saudi Arabia

- In January 2024, Saudi Telecom Company (STC), the leading telecommunications provider in Saudi Arabia, announced the launch of its Managed Security Services, aiming to protect businesses from cyber threats and ensure regulatory compliance (STC Press Release).

- In March 2024, IBM Saudi Arabia and the Saudi Arabian Mining Company (MA'aden) signed a strategic partnership to deliver managed IT services, focusing on cloud computing and data analytics to optimize MA'aden's operations (IBM Press Release).

- In May 2024, Saudi Aramco, the world's largest oil company, awarded a managed services contract to Schneider Electric to manage its energy efficiency projects, demonstrating a significant investment in energy management solutions (Schneider Electric Press Release).

- In February 2025, the Communications and Information Technology Commission (CITC) of Saudi Arabia issued new regulations mandating managed services for all telecom operators, ensuring better quality and standardization of services (CITC Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled {region_market_name}} insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 1053.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.2 |

|

Key countries |

Saudi Arabia and MEA |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving managed services market of Saudi Arabia, businesses increasingly adopt advanced solutions to optimize their IT infrastructure. Hybrid cloud management, a fusion of on-premises and cloud services, is gaining traction. A knowledge base, an integral component, enables seamless integration and management of these disparate systems. Cloud service providers offer Service Level Agreements (SLAs), ensuring reliable and efficient service delivery. Software-defined networking and IT service management tools facilitate multi-cloud management, allowing businesses to leverage various cloud platforms. Business continuity planning is a priority, with automation tools for incident management and IT consulting services ensuring business resilience.

- IT infrastructure outsourcing, a growing trend, enables organizations to focus on core competencies. Cybersecurity threat intelligence is a critical concern, with managed security services offering robust protection. A service catalog, a comprehensive list of IT offerings, enables easy selection and customization. Compliance audits ensure adherence to industry regulations. Application performance monitoring, ITIL framework, data center management, and network operations center services are essential for maintaining optimal IT performance. System integration services and disaster recovery services ensure business continuity during disruptions. Change management and help desk support streamline IT operations, while virtual desktop infrastructure and problem management tools enhance productivity.

- Capacity planning and remote infrastructure management enable businesses to scale effectively. Monitoring dashboards provide real-time insights into IT performance, enabling proactive decision-making.

What are the Key Data Covered in this Saudi Arabia Managed Services Market Research and Growth Report?

-

What is the expected growth of the Saudi Arabia Managed Services Market between 2025 and 2029?

-

USD 1.05 billion, at a CAGR of 6.8%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (MDS, MNS, MSS, MMS, and Others), Deployment (Cloud and On premises), End-user (Government, Financial services, Healthcare, Oil and gas, and Others), and Geography (Middle East)

-

-

Which regions are analyzed in the report?

-

Saudi Arabia

-

-

What are the key growth drivers and market challenges?

-

Rising demand for outsourcing in BFSI and retail sectors, Data and privacy issues

-

-

Who are the major players in the Managed Services Market in Saudi Arabia?

-

Key Companies ACS Services Inc., Amazon.com Inc., AO Kaspersky Lab, Atos SE, Cisco Systems Inc., Diyar United Co., eHosting DataFort, Fortinet Inc., Fujitsu Ltd., Google LLC, Hewlett Packard Enterprise Co., International Business Machines Corp., Juniper Networks Inc., Microsoft Corp., Nokia Corp., Palo Alto Networks Inc., Security Matterz, Telefonaktiebolaget LM Ericsson, Wipro Ltd., and Zoho Corp. Pvt. Ltd.

-

Market Research Insights

- The market continues to grow, with an increasing number of businesses adopting IT solutions to enhance operational efficiency and security. Two key areas driving this growth are network security services and IT governance. Network security services, including incident response plans, data loss prevention, and security vulnerability management, accounted for over 30% of the managed services market in 2020. In contrast, IT governance, which includes IT strategy, IT asset management, and IT support contracts, accounted for approximately 25% of the market.

- Uptime guarantees, a critical component of IT governance, have become increasingly important to businesses seeking to minimize downtime and maintain optimal system performance. With the ongoing adoption of cloud adoption frameworks, cloud migration services and remote server management are also gaining traction. Agile methodologies, such as DevOps practices and database administration, are increasingly being integrated into managed services offerings to improve agility and flexibility.

We can help! Our analysts can customize this Saudi Arabia managed services market research report to meet your requirements.