Tube And Stick Packaging Market Size 2024-2028

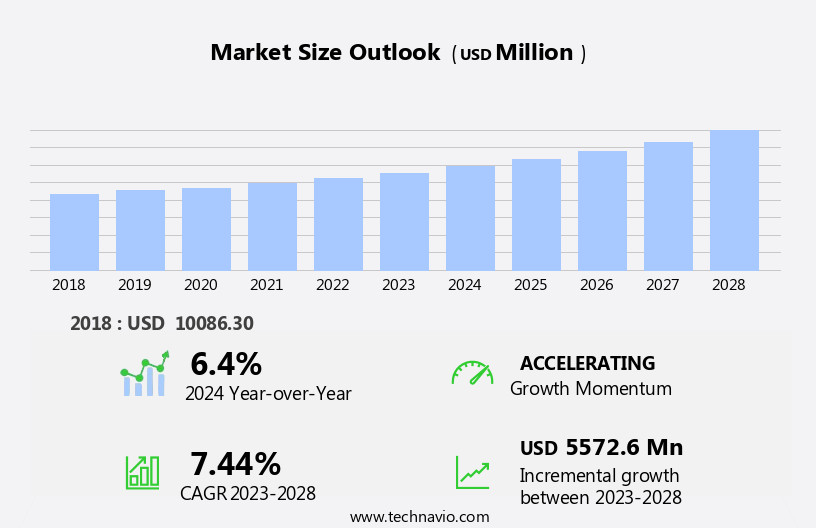

The tube and stick packaging market size is forecast to increase by USD 5.57 billion at a CAGR of 7.44% between 2023 and 2028.

The market is experiencing significant growth due to the increasing demand for convenience packaging. This trend is driven by consumers' preference for portable and easy-to-use packaging solutions. Another key factor fueling market growth is the rise in adoption of bioplastic-based packaging, which is gaining popularity due to its eco-friendliness and sustainability. However, stringent regulations on tube and stick packaging, particularly regarding material safety and product labeling, pose a challenge to market growth. Compliance with these regulations requires significant investment in research and development and regulatory approval processes. Overall, the market is expected to continue its growth trajectory, driven by these trends and challenges.

What will be the Size of the Tube And Stick Packaging Market During the Forecast Period?

- The market encompasses various types of containers, including squeeze and twist tubes, cartridges, and sticks, primarily used In the personal care, pharmaceutical, healthcare, skincare, food, and consumer goods industries. Market trends reflect a growing demand for advanced packaging solutions that offer enhanced shelf appeal, branding, labeling, and decorating capabilities. Material science innovations have led to the use of plastic, paper, aluminum, paperboard, and metal tubes and sticks, with a focus on sustainability, recyclability, and environmentally friendly packaging. Dermatology and healthcare sectors require specific packaging solutions to ensure product efficacy and patient safety. The food industry seeks packaging that maintains product freshness and extends shelf life.

- Overall, the market continues to evolve, driven by consumer preferences and industry advancements.

How is this Tube And Stick Packaging Industry segmented and which is the largest segment?

The tube and stick packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Cosmetic and oral care

- Food and beverages

- Pharmaceuticals

- Others

- Type

- Squeeze tubes

- Twist tubes

- Cartridge

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By End-user Insights

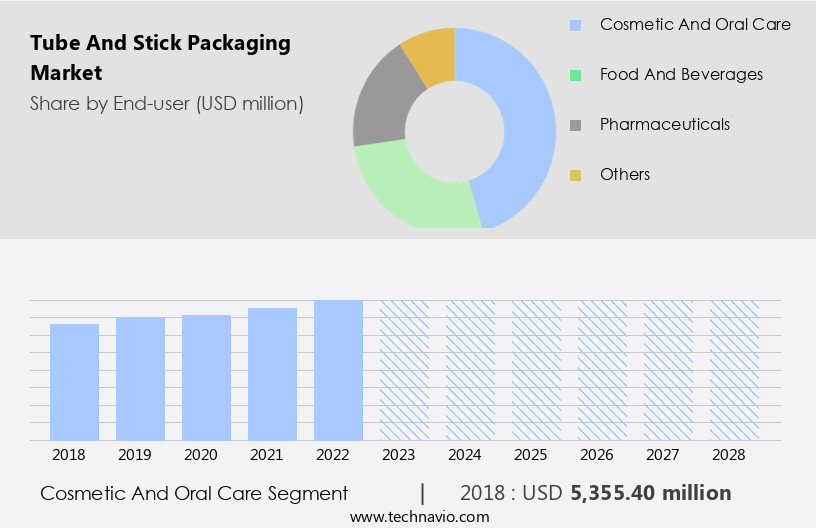

- The cosmetic and oral care segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth, particularly In the consumer goods sector, driven by the cosmetic and oral care segment. This segment encompasses products like toothpaste, lip balm, sunscreen, and hand cream. Convenience is a major factor fueling this market expansion. Tube packaging for toothpaste facilitates easy dispensing, while stick packaging for lip balm ensures mess-free application. These advantages cater to consumers' increasing demand for portable and hassle-free products. This trend is expected to continue, underscoring the importance of tube and stick packaging In the consumer goods industry.

Get a glance at the Tube And Stick Packaging Industry report of share of various segments Request Free Sample

The Cosmetic and oral care segment was valued at USD 5.36 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

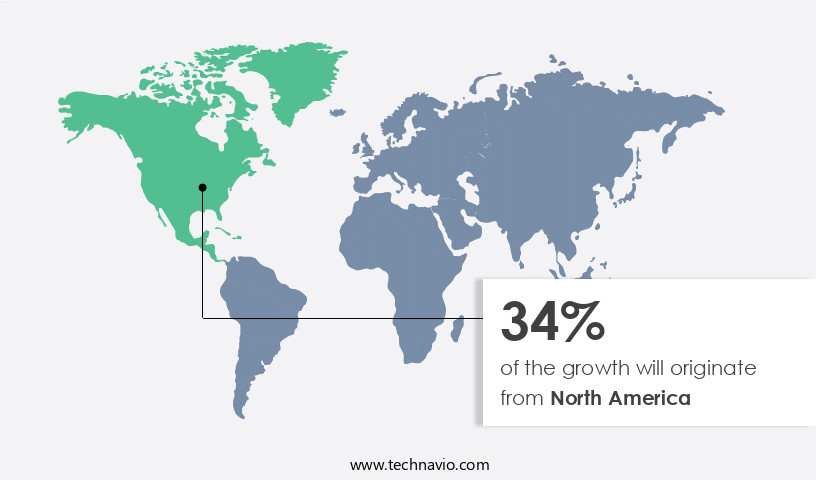

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the APAC region has experienced notable growth due to the expanding demand for these packaging solutions in sectors such as cosmetics, pharmaceuticals, and food and beverage. The cosmetics industry's surge is a significant driver, with brands increasingly opting for tube and stick packaging to cater to consumer preferences for convenience and ease of use. Products like lip balms, creams, and lotions benefit significantly from this packaging format. Similarly, the pharmaceutical industry's growth is contributing to the market's expansion, as tube and stick packaging offers advantages in terms of product protection and dosage control. Overall, the APAC region's the market is poised for continued growth, driven by the region's economic development and the increasing demand for innovative packaging solutions.

Market Dynamics

Our tube and stick packaging market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Tube And Stick Packaging Industry?

Increasing demand for convenience packaging is the key driver of the market.

- The market In the US is witnessing significant growth due to the increasing demand for advanced packaging solutions in various sectors. These include personal care, pharmaceutical, healthcare, skincare, food packaging, and consumer products. Tube packaging, such as that used for toothpaste, oral care products, creams, ointments, gels, and thick liquids, offers consumers the convenience of controlled dispensing and hygienic usage. Its plastic properties make it suitable for a wide range of applications, from dermatology medicines and biopharmaceutical company products to eatables and pharma products. Moreover, stick packaging, popularly used for food items like coffee, condiments, and snacks, is gaining traction due to its portability and convenience.

- The packaging business is embracing sustainable packaging solutions, such as plastic recycling and material technology, to cater to the growing environmental concerns. Sustainability is a key focus area, with an emphasis on bioplastics, recycled materials, and high-end materials. Consumer goods, cosmetics, and oral disease prevention products are major contributors to the market's growth. The government healthcare system and healthcare and hygiene sectors are also adopting tube and stick packaging for their periodontal disease treatments and other pharmaceutical offerings. The packaging industry is leveraging printing methods like digital technology to enhance shelf appeal, branding, labeling, and decorating. The convenience, sustainability, and recyclability of these packaging solutions make them an environmentally friendly choice for both retail outlets and e-commerce platforms.

- Material science plays a crucial role In the development of tube and stick packaging, ensuring the products' durability, functionality, and compatibility with various raw materials, such as petroleum, plastics, and resins.

What are the market trends shaping the Tube And Stick Packaging Industry?

Rise in adoption of bioplastic-based packaging is the upcoming market trend.

- The market is witnessing significant growth due to the increasing adoption of advanced packaging solutions, particularly In the sectors of personal care, pharmaceutical, healthcare, skincare, and food packaging. Biodegradable and sustainable packaging materials, such as bioplastics derived from renewable resources like starch, cellulose, and vegetable oil, are gaining popularity. These materials offer several advantages, including easy decomposition, reducing environmental pollution, and aligning with consumers' growing preference for eco-friendly products. The healthcare industry, including dermatology and medicines from biopharmaceutical companies, is also embracing these advanced packaging solutions for their pharmaceutical and health care products. The convenience and portability offered by tube and stick packaging are also driving its demand in retail outlets and e-commerce platforms.

- Additionally, material technology advancements, such as sustainable packaging, plastic recycling, and the use of high-end materials like aluminum and paperboard, are further fueling market growth. The flexibility of these packaging solutions in terms of decorating, labeling, and printing methods, including digital printing technology, also adds to their appeal. The focus on sustainability, recyclability, and environmentally friendly packaging is expected to continue shaping the market In the US.

What challenges does the Tube And Stick Packaging Industry face during its growth?

Stringent regulations on tube and stick packaging is a key challenge affecting the industry growth.

- Tube and stick packaging, which includes squeeze tubes, twist cartridges, and stick packs, is a significant market In the consumer goods industry. Plastic, paper, and aluminum are common materials used in this type of packaging for various applications, such as personal care, pharmaceutical, healthcare, skincare, food packaging, and advanced packaging solutions. Strict regulations have been imposed globally to minimize the environmental impact of single-use plastics, leading companies to explore sustainable packaging alternatives. The European Union's Single-Use Plastics Directive, implemented in July 2019, restricts the production and sale of certain single-use plastic items, including tubes and stick packs, to reduce their consumption.

- This directive is just one example of the regulatory landscape shaping the market. Material technology advancements, such as sustainable packaging, plastic recycling, and bioplastics, have gained traction in recent years. Consumer products, cosmetic products, oral disease treatments, and pharma products are some sectors that heavily rely on tube and stick packaging. The convenience and portability offered by these packaging solutions make them popular in retail outlets and e-commerce channels. Flexible packaging, which is increasingly being used for tube and stick packaging, offers advantages such as shelf appeal, branding, labeling, and decorating. The use of high-end materials, such as metal, paperboard, and advanced printing methods like digital printing technology, enhances the overall appeal and sustainability of these packages.

- The market is expected to grow due to its versatility, recyclability, and environmentally friendly packaging properties. The market dynamics are influenced by factors such as consumer preferences, government regulations, and technological advancements. The industry's future is promising, as companies continue to innovate and adapt to the changing regulatory landscape and consumer demands.

Exclusive Customer Landscape

The tube and stick packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tube and stick packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, tube and stick packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Amcor Plc - Our company provides tube and stick packaging solutions under the brand name StickPack. This innovative packaging format offers numerous benefits, including convenience, portability, and increased product protection. StickPack is ideal for various industries, including nutraceuticals, food, and cosmetics, providing a sleek and modern alternative to traditional packaging options. With a focus on sustainability, these eco-friendly packages are recyclable and biodegradable, making them an excellent choice for environmentally-conscious consumers. Our tube and stick packaging solutions are designed to meet the unique needs of businesses, ensuring product differentiation and enhanced brand recognition.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- ARANOW Packaging Machinery SL

- Armbrust Paper Tubes Inc.

- Assemblies Unlimited Inc.

- Berry Global Inc.

- CCL Industries Inc.

- Clariant International Ltd.

- Constantia Flexibles Group GmbH

- EPL Ltd.

- Hoffmann Neopac AG

- Huhtamaki Oyj

- Mondi Plc

- Plastek Industries Inc.

- Plastube

- Precision Concepts International

- Sinclair and Rush Inc.

- Sonic Packaging Industries Inc.

- Technical Help in Engineering and Marketing

- The Estee Lauder Companies Inc.

- World Wide Packaging LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Understanding the Dynamics of the market the market encompasses a diverse range of products used in various industries, including personal care, pharmaceutical, healthcare, skincare, food packaging, and advanced packaging solutions. This market is characterized by its ability to cater to the unique requirements of different sectors while maintaining a balance between functionality, sustainability, and aesthetics. In the personal care sector, tube packaging has gained significant popularity due to its versatility. These tubes can accommodate various products, such as creams, ointments, gels, and thick liquids, making them an ideal choice for cosmetic and oral care products. The demand for tube packaging In the oral care segment is particularly high, with toothpaste being the most common application.

The convenience and portability offered by tube packaging make it a preferred choice for consumers, especially In the context of e-commerce and retail outlets. The pharmaceutical and healthcare industries rely on tube and stick packaging for their dermatology and medicines. These packaging solutions ensure the preservation of sensitive formulations, protecting them from external factors and maintaining their efficacy. The use of advanced material technology in tube and stick packaging has led to the development of sustainable packaging solutions, such as bioplastics and recycled materials. These eco-friendly alternatives cater to the growing consumer demand for environmentally friendly packaging. Food packaging is another significant application area for tube and stick packaging.

The use of plastic, paper, aluminum, and metal materials in tube and stick packaging offers various benefits, including shelf appeal, branding, labeling, and decorating. The convenience and portability of these packaging solutions make them suitable for a wide range of eatables, from sauces and spreads to beverages and desserts. Advanced packaging solutions In the tube and stick market cater to the unique needs of high-end consumer products and pharma products. These solutions often incorporate material science and recyclability to create sustainable and recyclable packaging. Digital printing technology is increasingly being used to enhance the visual appeal of these packages, making them more attractive to consumers.

The market is influenced by various factors, including material properties, consumer preferences, and government regulations. The demand for sustainable packaging solutions is driving the market towards the use of recycled materials and bioplastics. Consumer preferences for convenience and portability continue to shape the market, with flexible packaging gaining popularity. Government regulations, particularly In the healthcare sector, are driving the adoption of advanced packaging solutions to ensure the safety and efficacy of products. The raw materials used in tube and stick packaging, such as petroleum, plastics, and resins, significantly impact the market dynamics. The price fluctuations of these raw materials can affect the cost of production and, consequently, the pricing strategy of manufacturers.

The availability and cost of sustainable raw materials, such as bioplastics and recycled materials, are also crucial factors influencing the market. In conclusion, the market is a dynamic and diverse industry that caters to various sectors while addressing the evolving needs of consumers and regulatory bodies. The use of advanced material technology, sustainable packaging solutions, and digital printing technology is transforming the market, offering new opportunities for growth and innovation.

|

Tube And Stick Packaging Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.44% |

|

Market growth 2024-2028 |

USD 5572.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Tube And Stick Packaging Market Research and Growth Report?

- CAGR of the Tube And Stick Packaging industry during the forecast period

- Detailed information on factors that will drive the Tube And Stick Packaging growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the tube and stick packaging market growth of industry companies

We can help! Our analysts can customize this tube and stick packaging market research report to meet your requirements.