Sanitary Valves Market in US Size 2024-2028

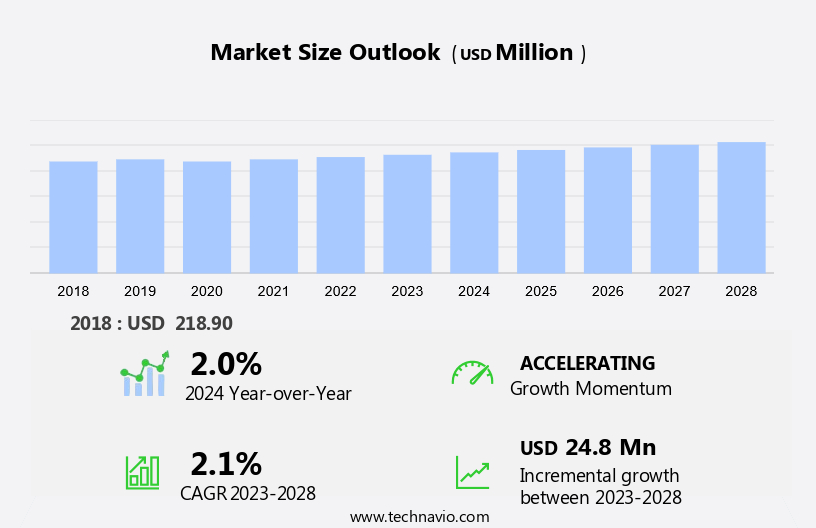

The sanitary valves market in US size is forecast to increase by USD 24.8 million at a CAGR of 2.1% between 2023 and 2028.

- The sanitary valve market is witnessing significant growth due to the increasing demand for machinery in industries such as food and beverages and pharmaceuticals. These industries require a sterile environment for the production of ready-to-eat food and pharmaceutical products. Sanitary ball valves and sanitary pumps are essential components in maintaining hygiene and sanitation in these industries. A key trend in the market is the development of smart technology in valve positioners and actuators.

- For instance, Unibloc Pump's intelligent valve positioners offer precise control and monitoring capabilities. Additionally, the increasing popularity of online food aggregators and the demand for aseptic and pharmaceutical valves are driving market growth. However, fluctuations in raw material prices pose a challenge to market growth. Manufacturers must balance the cost of producing high-quality sanitary valves with the need to remain competitive in the market. Overall, the sanitary valves market is expected to continue its growth trajectory due to the increasing demand for hygiene and sanitation in various industries.

What will be the Size of the Market During the Forecast Period?

- The sanitary valves market holds significant importance in various industries where maintaining cleanliness and preventing contamination are crucial. These industries include food and beverage processing, pharmaceuticals, biotechnology, cosmetics, and semiconductors. In the context of food and beverage production, sanitary valves play a vital role in ensuring hygiene standards are met. The implementation of these valves in hydraulic systems, pressure regulation, and flow control applications helps maintain the required cleanliness levels, thereby preventing contamination and ensuring the production of safe and high-quality products. Pharmaceutical and biotechnology industries require stringent hygiene and sanitation practices to maintain the integrity of their processes.

- Similarly, sanitary valves, made primarily from corrosion-resistant stainless steel, are essential in these industries due to their ability to withstand harsh chemicals and maintain the required cleanliness levels. Cosmetics manufacturing also relies on sanitary valves to maintain hygiene and prevent contamination. The use of these valves in fluid management applications, such as centrifugal pumps and positive displacement pumps, helps maintain the purity of the fluids used in cosmetic production. The semiconductor industry, which deals with the production of electronic components, also utilizes sanitary valves in its processes. The need for sterilization and maintaining aseptic conditions is crucial in this industry, and sanitary valves help ensure the required cleanliness levels are met.

- Additionally, the adoption of automation in various industries has led to an increased demand for sanitary valves. These valves are used in isolation valves, control valves, and sanitary pumps applications to maintain the required cleanliness levels and ensure efficient fluid management. In conclusion, the sanitary valves market plays a crucial role in various industries where maintaining hygiene and preventing contamination are essential. The use of these valves in applications such as hydraulic systems, pressure regulation, flow control, sterilization, and fluid management helps ensure the production of safe and high-quality products in the food and beverage, pharmaceutical, biotechnology, cosmetics, and semiconductor industries.

How is this market segmented and which is the largest segment?

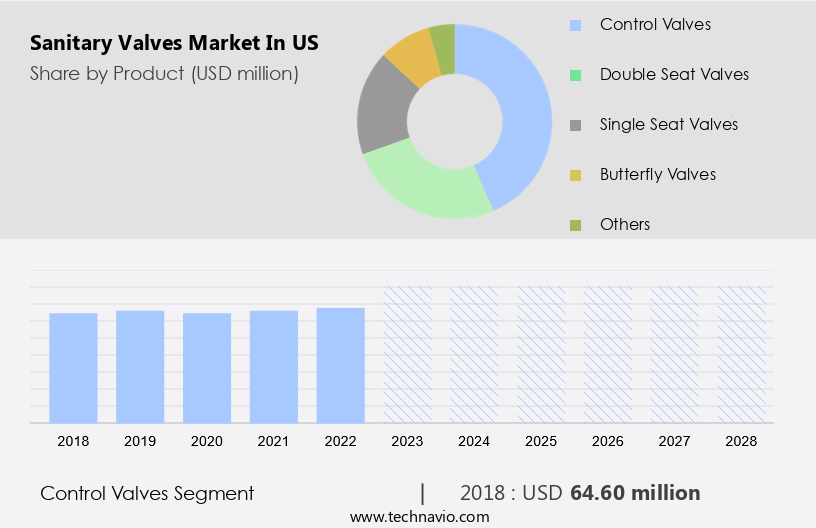

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Control valves

- Double seat valves

- Single seat valves

- Butterfly valves

- Others

- End-user

- Pharmaceutical

- Processed food

- Beverages

- Dairy

- Others

- Geography

- US

By Product Insights

- The control valves segment is estimated to witness significant growth during the forecast period.

In the pharmaceutical, biotech, food and beverage, cosmetic, and dairy industries, control valves play a crucial role in maintaining hygienic conditions. These valves are essential for hydraulic control applications that require pressure, force, and positional control. One type of control valve that is gaining popularity is the sanitary ball valve, which is ideal for applications in a sterile environment. The control valves market in the US is expected to grow significantly during the forecast period due to increasing regulations regarding environmental and work safety.

Additionally, these regulations necessitate the use of efficient control valves to ensure compliance. However, the market faces challenges from counterfeit and fraudulent products, which can impact revenue and brand reputation. Sanitary pumps, such as the Unibloc Pump, and valve positioners with smart technology are also crucial components in maintaining hygiene and sanitation in industries that produce ready-to-eat food and pharmaceutical products. It is essential for manufacturers to invest in authentic products and solutions to maintain their brand image and ensure customer trust.

Get a glance at the market report of share of various segments Request Free Sample

The control valves segment was valued at USD 64.60 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Sanitary Valves Market in US?

Increasing adoption of sanitary valves in food and beverages and pharmaceutical industries is the key driver of the market.

- In the food and beverages and pharmaceutical sectors, maintaining a hygienic and sanitized environment is of utmost importance. Sanitary valves play a crucial role in managing fluids in these industries, ensuring compliance with stringent regulations. The organic growth in these industries, driven by consumer demand for healthy and nutritious food and beverages, as well as the increasing popularity of ready-to-eat food in the US, fuels the expansion of the global sanitary valves market. Carbon steel, PVC, and PFA are commonly used materials for sanitary valves due to their resistance to corrosion and ease of cleaning. These valves are essential components in various applications, including pharmaceutical manufacturing, chemical processing, water treatment, and dairy processing.

- Additionally, centrifugal pumps, positive displacement pumps, and rotary pumps are some of the pump types that utilize sanitary valves for fluid transfer. Sterilization processes also rely on these valves to maintain hygiene standards. In summary, the sanitary valves market is experiencing significant growth due to the increasing demand for hygienic and sanitized environments in the food and beverages and pharmaceutical industries. The use of various types of pumps, such as centrifugal, positive displacement, and rotary pumps, necessitates the adoption of sanitary valves to ensure efficient fluid management and maintain regulatory compliance.

What are the market trends shaping the Sanitary Valves Market in US?

The development of smart actuators is the upcoming trend in the market.

- Sanitary valves play a crucial role in maintaining cleanliness and preventing contamination in various industries such as food and beverage, pharmaceutical, biotechnology, and cosmetics. These industries require strict adherence to hygiene standards, making the use of sanitary valves essential. Stainless steel valves, known for their corrosion resistance, are commonly used in these applications. Hydraulic systems, which utilize hydraulic valves for pressure regulation and flow control, also benefit from the use of sanitary valves.

- Additionally, advancements in actuator technology have led to the development of smart actuators, which enable end-users to gather valuable data for predictive maintenance. In power plants, for instance, smart actuators can be used to profile the torque characteristics of valves. This data can be stored in the asset management system and compared with historical data to identify potential issues before they escalate, reducing operational and maintenance downtime. In summary, sanitary valves are essential in maintaining cleanliness and preventing contamination in various industries. The adoption of smart actuators and predictive maintenance solutions has led to significant advancements in valve technology, enabling end-users to gather valuable data for improved maintenance and operational efficiency.

What challenges does Sanitary Valves Market in US face during the growth?

Fluctuation in raw material prices of sanitary valves is a key challenge affecting the market growth.

- In the production of sanitary valves, the selection of raw materials plays a significant role in both functionality and cost. Stainless steel, a common material choice due to its resistance to corrosion and ability to meet food-grade requirements, accounts for a substantial portion of the manufacturing cost. Other materials, such as copper, cast iron, aluminum, brass, and bronze, are also utilized in the fabrication of these valves. However, the price of these raw materials can be influenced by demand from various industries, thereby impacting the profitability of sanitary valve suppliers. The manufacturing process of sanitary valves necessitates the use of specialized materials to ensure equipment cleanliness and prevent contamination.

- For instance, stainless steel is a popular choice due to its resistance to corrosion and compatibility with food-grade applications. This material is used extensively in industries such as fermentation, mixing, spraying, preservation, air filtration, transportation, and custom-made healthcare products. The cost of these raw materials can fluctuate based on demand from these industries, ultimately affecting the pricing of sanitary valves. In the realm of biotechnology and energy efficiency, sanitary valves are designed with hygienic principles in mind.

- However, hygienic design ensures the prevention of contamination and the maintenance of a clean environment, making these valves essential in various applications. As such, the use of high-quality, food-grade materials is crucial to meet the stringent requirements of these industries. The cost of these materials, particularly stainless steel, can significantly impact the overall price of sanitary valves.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adamant Valves

- Alfa Laval AB

- Burkert India Pvt. Ltd.

- Cashco Inc.

- Check All Valve Manufacturing Co.

- Dixon Valve and Coupling Co. LLC

- Dunham Rubber and Belting Corp.

- Emerson Electric Co.

- GEA Group AG

- Habonim Industrial Valves and Actuators Ltd.

- INOXPA USA Inc.

- Krones AG

- Liquidyne Process Technologies Inc.

- Lumaco

- Parker Hannifin Corp.

- Richards Industrials

- SAMSON AG

- Schubert and Salzer Inc.

- SPX FLOW Inc.

- SVF Flow Controls LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Sanitary valves play a crucial role in maintaining cleanliness and preventing contamination in various industries, including food and beverage, pharmaceutical, biotechnology, cosmetics, and semiconductor manufacturing. These industries require strict adherence to hygiene standards for the production of ready-to-eat food, online food aggregators, and custom-made healthcare products. Stainless steel valves, such as sanitary ball valves, are widely used due to their corrosion resistance and ability to withstand harsh environments. Hydraulic systems in machinery rely on hydraulic valves for pressure regulation and flow control. Pharmaceutical manufacturing, chemical processing, water treatment, and dairy processing all benefit from sanitary valves.

Furthermore, the use of materials like stainless steel, alloy steel, carbon steel, PVC, and PFA ensures equipment cleanliness and prevents contamination. Smart technology, such as valve positioners and automation, is increasingly being adopted for improved efficiency and hygiene in these industries. Pharmaceutical valves, aseptic valves, and isolation valves are essential for maintaining a sterile environment in pharmaceutical manufacturing. Sanitary pumps, including centrifugal pumps, positive displacement pumps, and rotary pumps, are used for fluid management in various applications, such as fermentation, mixing, spraying, preservation, and air filtration. Transportation of fluids in the food and beverage industry also relies on sanitary valves to maintain hygiene and prevent contamination.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.1% |

|

Market growth 2024-2028 |

USD 24.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.0 |

|

Key countries |

US and North America |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch