Organic Whey Protein Market Size 2024-2028

The organic whey protein market size is forecast to increase by USD 392.7 billion at a CAGR of 7% between 2023 and 2028.

- The market is experiencing significant growth due to various factors. One key driver is the increasing demand from cancer patients undergoing radiation therapy and chemotherapy, who seek natural sources of protein to aid in their recovery. Additionally, the market is witnessing a trend towards the use of organic whey protein in skincare and hair care products as functional ingredients. In the food and beverage industry, packaged foods and dietary supplements are incorporating organic whey protein concentrate and isolate as healthier alternatives. The growing preference for plant-based diets is also fueling the demand for vegan protein powders. Furthermore, the convenience of online sales through e-commerce channels is making organic whey protein more accessible to consumers. These factors are expected to continue driving market growth In the coming years.

What will be the Size of the Organic Whey Protein Market During the Forecast Period?

- Organic whey protein is a high-value food ingredient derived from the process of making cheese. Its nutritional benefits have made it a popular choice among consumers seeking to maintain a healthy lifestyle and support their fitness goals. This market outlook provides an analysis of the current trends and insights driving the demand for organic whey protein. Protein supplements have gained significant traction in various sectors, including fitness clubs and food and beverages. Organic whey protein, as a high-protein food ingredient, is increasingly being used in the production of dietary supplements, functional foods, and sports nutrition products. Natural products with a well-balanced amino acid profile and clean label certifications are gaining popularity in protein shakes, as they offer essential nutrients with low fat content, promoting performance enhancement and supporting healthier lifestyles.

- The growing health consciousness among consumers is fueling the demand for organic whey protein as a key ingredient in these applications. Organic whey protein offers several health benefits, such as antibacterial and antihypertensive properties, making it an ideal choice for consumers looking for immunity-boosting products. Additionally, its high nutritional value, including a high biological value, makes it a popular choice for those following protein-rich diets. The increasing prevalence of lactose intolerance has led to the demand for low-lactose and lactose-free organic whey protein products. This trend is particularly prominent in the e-commerce sector, where consumers can easily access a wide range of organic whey protein options from various brands. Organic whey protein is also finding applications in industries beyond food and beverages. It is being used as a functional food ingredient in cosmetics and dairy ingredients, providing additional benefits to consumers.

How is this Organic Whey Protein Industry segmented and which is the largest segment?

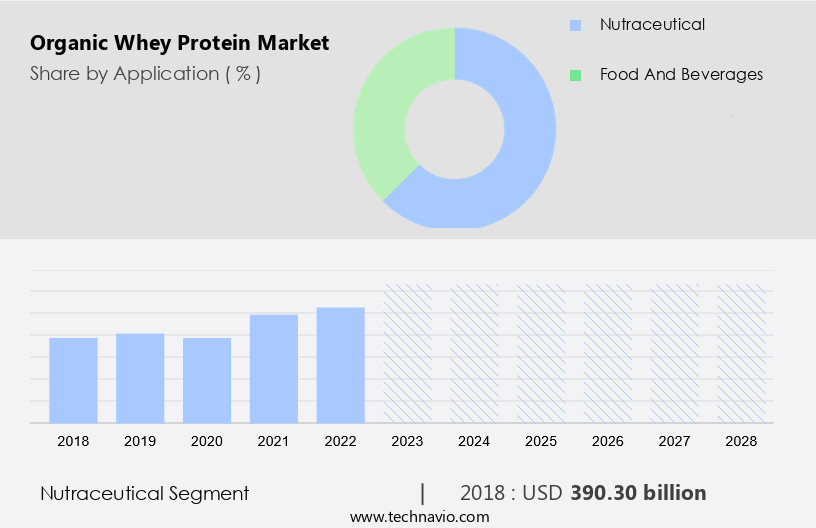

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Nutraceutical

- Food and beverages

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Application Insights

- The nutraceutical segment is estimated to witness significant growth during the forecast period. Nutraceuticals, which encompass food or food components with additional health benefits, have gained popularity in the US due to their ability to aid in disease treatment and prevention, all while minimizing side effects. These nutraceuticals fall under the jurisdiction of the US Food and Drug Administration (FDA) as dietary supplements. The increasing distrust towards conventional medicines and the emergence of food trends, such as poke bowls and nootropics, have fueled the demand for nutraceuticals. One such nutraceutical is organic whey protein, derived from milk and accounting for approximately 20% of its total protein content. It is renowned for its rich supply of branched and essential amino acids, functional peptides, antioxidants, and immunoglobulins.

- Organic whey protein is widely used in various applications, including cancer patient care during radiation therapy and chemotherapy, as well as in the production of skincare and hair care products. Furthermore, it is incorporated into functional ingredients for packaged food, dietary supplements, and food and beverages. Whey protein concentrate and isolate are popular forms of organic whey protein, with the former retaining more lactose and fat, while the latter is more refined and contains fewer impurities. These forms are used extensively in the nutraceuticals industry due to their versatility and nutritional value.

Get a glance at the market report of share of various segments Request Free Sample

The Nutraceutical segment was valued at USD 390.30 billion in 2018 and showed a gradual increase during the forecast period.

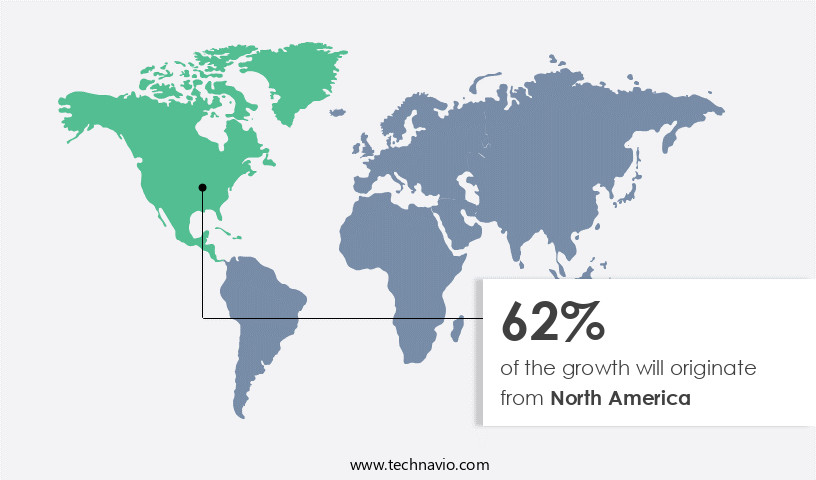

Regional Analysis

- North America is estimated to contribute 62% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in North America is thriving due to the increasing consumer preference for essential amino acid-rich, clean-label protein sources. The region's large health clubs and fitness centers catering to health-conscious individuals further fuel the demand for organic whey protein. Customized protein options and new flavors in organic whey protein health drinks are also driving market growth. Online retailing has made organic whey protein easily accessible to consumers, further expanding the market's reach. The US and Canada are the major contributors to the market in North America. The US, being the largest consumer and exporter of organic whey protein globally, has a significant impact on market growth.

For more insights on the market size of various regions, Request Free Sample

The presence of numerous cheese producers in the US, who obtain whey as a byproduct of the cheese production process, is a significant factor contributing to the market's expansion. Antioxidant properties of organic whey protein make it an attractive option for health-conscious consumers, leading to its growing popularity. The market's shift towards non-GMO and clean-label products is another factor driving growth. However, the risk of adulteration in non-organic food products is a concern for consumers, further increasing the demand for organic whey protein.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Organic Whey Protein Industry?

- Increasing product launches and innovation is the key driver of the market. Organic whey protein is derived from the byproduct of cheese production, which is a liquid remaining after milk has been curdled and strained. This protein source gains popularity due to its organic origin from milk sourced from cattle raised on organic farms and fed grass. The increasing consumer preference for plant-based proteins and veganism does not diminish the demand for the protein. It expands the market as some consumers opt for protein-rich diets that include both plant-based and animal-derived proteins. Moreover, organic whey protein finds applications in various industries. In the food industry, it is used for protein fortification in baby food and beverages.

- In the cosmetics industry, it serves as a skin-softening agent and hair conditioning agent. In the infant formula sector, it is a valuable ingredient due to its high nutritional value. With the rise in consumer awareness about health and wellness, the demand continues to increase. Companies in the market respond to this trend by introducing new products to cater to the demands of consumers. Biodegradable packaging is also used to align with the eco-friendly preferences of consumers. The availability of raw materials, such as organic milk and cheese, is also a significant factor driving the growth of the market.

What are the market trends shaping the Organic Whey Protein Industry?

- Increasing use of the e-commerce channel for sales is the upcoming market trend. In today's health-conscious world, the demand for high-quality protein supplements, such as Whey Protein, continues to rise. As more individuals embrace healthy lifestyles, the market for these nutritious food products expands. Whey Protein, with its antibacterial and antihypertensive properties, is a popular choice among consumers seeking to boost their immunity and enhance their overall wellbeing. companies capitalize on this trend by marketing their offerings through various channels, including e-commerce platforms. The convenience of online shopping has made it possible for companies to reach a wider audience, delivering their products from a central distribution hub. These digital marketplaces not only provide a platform for sales but also serve as a medium for communication, allowing companies to inform customers about new product launches, their potential health benefits, and usage instructions.

- By utilizing e-commerce sites effectively, companies can broaden the visibility of their products and engage their customers with compelling brand stories. This strategic approach not only helps in building brand loyalty but also contributes to the growth of the market for high-protein, low-lactose, and immunity-boosting products. Additionally, the use of edible films and other advanced packaging solutions further enhances the appeal of these products, making them more attractive to health-conscious consumers.

What challenges does the Organic Whey Protein Industry face during its growth?

- Growing popularity of vegan protein powders is a key challenge affecting the industry growth. The shift towards plant-based diets and a heightened focus on health and wellness have fueled the expansion of the vegan population. This demographic does not consume animal products, including milk, eggs, or dairy derivatives like cheese and butter. Consequently, the demand for plant-based protein sources, such as pea protein and hemp protein, has escalated. Organic whey protein, while popular, faces increasing competition due to the growing preference for plant-based alternatives. Chronic illnesses, weight management, and lifestyle-related diseases have led individuals to seek nutritional supplements to address malnutrition and nutrient fortification. Consumers are increasingly concerned about food quality and the risk of adulterated supplements.

- Online retail platforms have made it easier for consumers to access these nutritional supplements, ensuring food functional characteristics align with their health goals. The market is expected to experience significant growth as it offers numerous health benefits. However, ensuring the authenticity and quality of these supplements remains a priority for consumers.

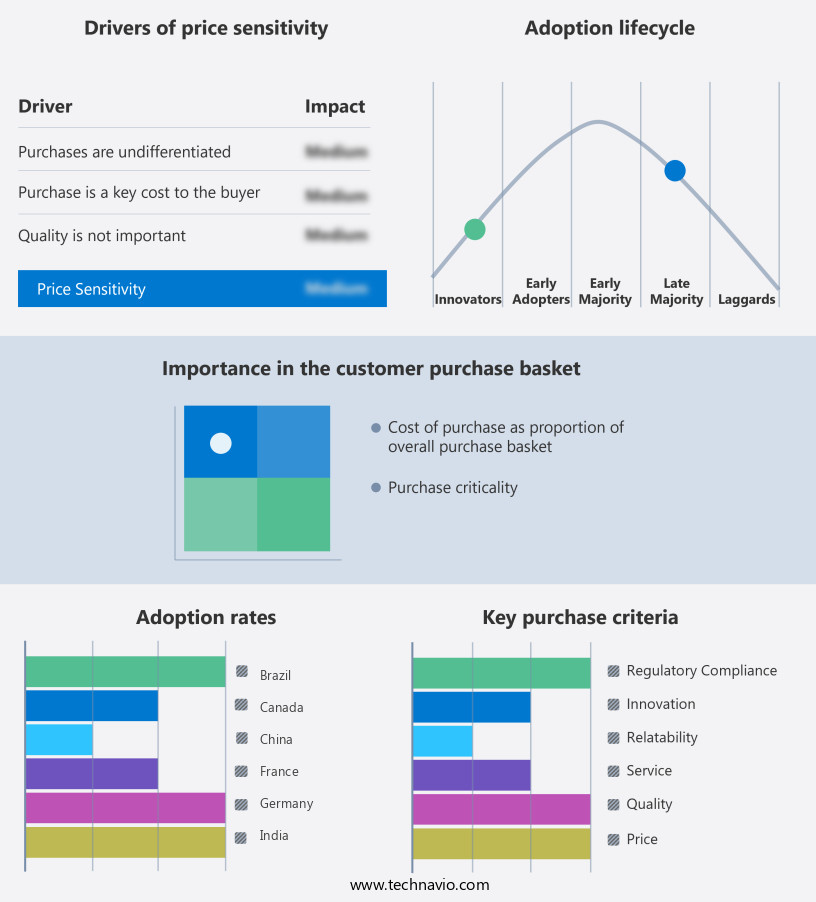

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arla Foods amba

- Bio Synergy Ltd.

- ConnOils LLC

- DMK Deutsches Milchkontor GmbH

- Glanbia plc

- Hilmar Cheese Co. Inc.

- Leprino Foods Co.

- Milk Specialties Global

- Mopro Nutrition LLC

- Natural Force Benefit Co.

- Nestle SA

- NOW Health Group Inc.

- Organic Valley

- Pro Amino International Inc.

- Puori ApS

- The Carrington Tea Company LLC

- The Organic Protein Co.

- Vital Proteins LLC

- Wheyd Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Whey protein, a high-quality protein sourced from milk, has gained immense popularity in the food and beverages industry due to its numerous health benefits. This versatile protein supplement is known for its antibacterial and antihydrative properties, making it an ideal choice for those following healthy lifestyles. With an impressive biological value, it is a complete protein that provides all essential amino acids required for optimal body function. The protein is a preferred choice for many due to its purity and nutritional value. It is free from adulteration and is produced using organic farming practices. This food ingredient is not only used as dietary supplements but also as functional ingredients in various industries.

Moreover, it is widely used in the food industry for protein fortification in packaged food, edible films, and functional foods. In the healthcare sector, it is used in the production of skincare and hair care products, as well as in the treatment of cancer patients undergoing radiation therapy and chemotherapy. The demand is on the rise due to the increasing health consciousness among consumers. The protein-rich diet trend and the growing popularity of sports nutrition have also contributed to its increasing demand. The e-commerce sector has made it easier for consumers to access these products, leading to online retailing becoming a significant distribution channel.

Furthermore, the protein is also used in the production of customized protein powders with new flavors and clean-label products. It is a popular choice for those with lactose intolerance, as low-lactose products are available. The protein-rich diet trend and the growing awareness of lifestyle-related diseases have led to an increase in the demand for nutritional supplements, further boosting the market for organic whey protein.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market growth 2024-2028 |

USD 392.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Key countries |

US, Germany, Canada, France, The Netherlands, China, India, Brazil, Japan, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.