Corporate M-Learning Market Size 2024-2028

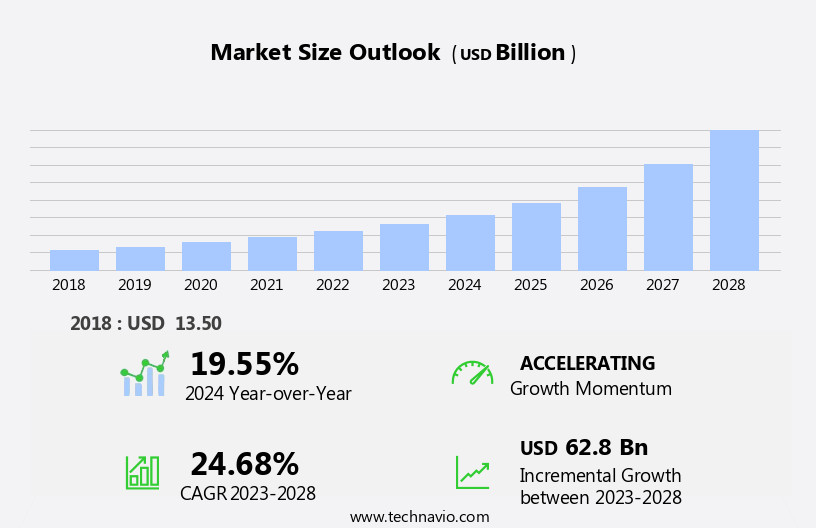

The corporate m-learning market size is forecast to increase by USD 62.8 bn at a CAGR of 24.68% between 2023 and 2028.

What will be the Size of the Corporate M-Learning Market During the Forecast Period?

How is this Corporate M-Learning Industry segmented and which is the largest segment?

The corporate m-learning industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Technical corporate m-learning

- Non-technical corporate m-learning

- End-user

- Large organizations

- Small and medium-sized enterprises

- Geography

- APAC

- India

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Type Insights

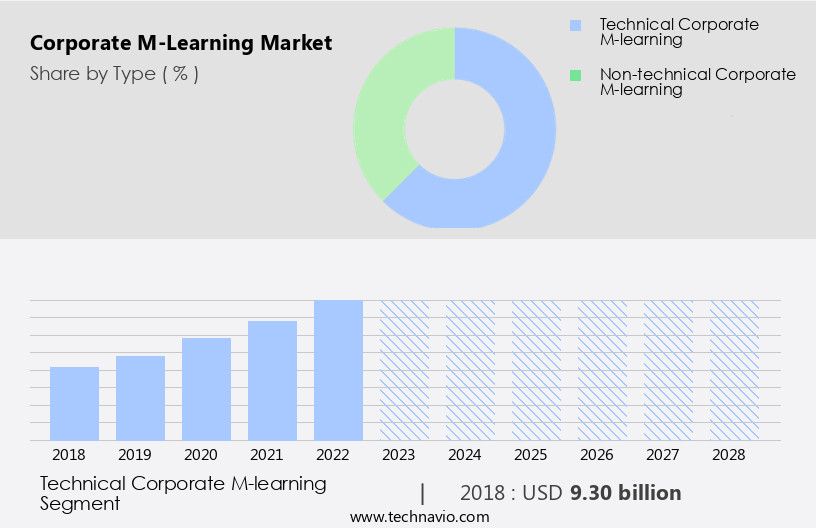

- The technical corporate m-learning segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing requirement for remote workforce training in various sectors such as IT, healthcare, finance, manufacturing, and others. With the widespread use of smartphones and high-speed mobile internet, learning solutions have become more accessible and scalable through mobile app development and cloud-based platforms. Advanced technologies like artificial intelligence (AI) and machine learning (ML) enable personalized learning experiences, while virtual reality (VR) and augmented reality (AR) offer immersive training methods. Globalization of businesses and the rise of telecommuting have led to the adoption of digital training solutions for consistent experiences. M-learning market includes mobile devices like laptops, tablets, and smartphones, as well as software solutions, content development, and interactive assessments.

Key benefits include increased operational efficiency, employee motivation, retention, and job satisfaction, and enterprise brand equity. Technical training, including IT skills, is a crucial component of this market, enabling quick adoption of new technologies and methodologies.

Get a glance at the Corporate M-Learning Industry report of share of various segments Request Free Sample

The Technical corporate m-learning segment was valued at USD 9.30 bn in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

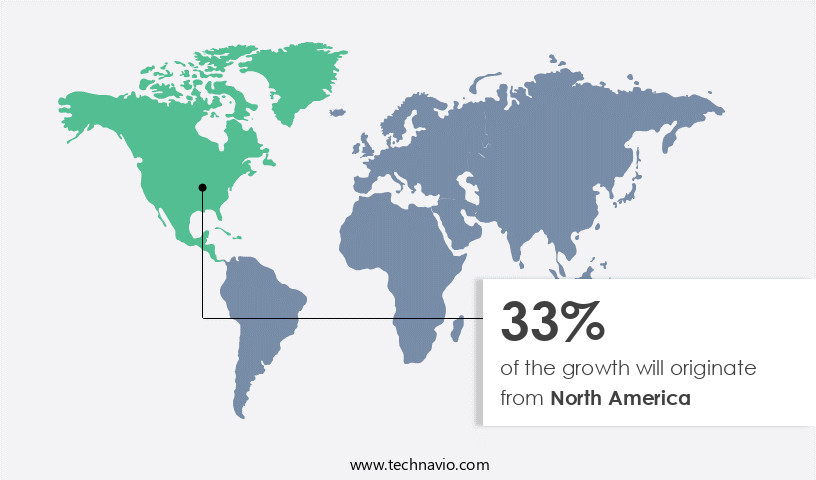

- North America is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing significant growth, driven by the large population and high adoption of mobile devices in countries like Japan, South Korea, India, and China. The increase in Internet penetration and awareness of diverse learning methods are also contributing factors. In China, the market's expansion is attributed to the thriving manufacturing and financial sectors, making it a global manufacturing hub. Mobile learning solutions, including mobile apps, cloud-based platforms, and AI-driven personalized learning experiences, are increasingly popular among employees in large organizations, startups, and workforces. M-learning offers flexible, engaging, and cost-effective alternatives to traditional in-person training, with benefits such as reduced expenses on travel, accommodation, and venue rental.

Key trends include the integration of multimedia, interactive content, gamification, simulations, and adaptive learning technologies. The market is further influenced by the globalization of businesses, telecommuting, and the gig economy, as well as advancements in 5G technology and mobile content authoring.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Corporate M-Learning Industry?

Reduction in employee training cost for employers is the key driver of the market.

What are the market trends shaping the Corporate M-Learning Industry?

Growing popularity of game-based learning is the upcoming market trend.

What challenges does the Corporate M-Learning Industry face during its growth?

Data security and privacy issues is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The corporate m-learning market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the corporate m-learning market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, corporate m-learning market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Adobe Inc. - The market refers to the deployment of mobile learning solutions for enterprise training and development. This sector has experienced significant growth due to the increasing adoption of mobile devices for professional education and the need for flexible, on-the-go learning opportunities. Companies are investing in mobile learning platforms to enhance employee productivity, engagement, and skill development. These solutions enable access to training materials, assessments, and collaboration tools from anywhere, at any time. The market is driven by factors such as the proliferation of mobile devices, the demand for personalized learning experiences, and the need for cost-effective training solutions. Additionally, advancements in technology, including artificial intelligence and virtual reality, are enhancing the effectiveness and interactivity of mobile learning platforms. Overall, the market is poised for continued growth as organizations seek to equip their workforce with the skills necessary to thrive in today's digital economy.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adobe Inc.

- Allen Interactions Inc.

- Aptara Inc.

- Articulate Global Inc.

- Blackboard Inc.

- Citrix Systems Inc.

- Cornerstone OnDemand Inc.

- D2L Inc

- dominKnow Inc.

- EdApp

- Higher Learning Technologies Corp.

- Kallidus Ltd.

- Koch Industries Inc.

- Learning Pool

- Meridian Knowledge Solutions LLC

- Promethean World Ltd.

- Qstream Inc.

- SumTotal Systems LLC

- Upside Learning Solutions Pvt. Ltd.

- Yarno

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to experience significant growth as businesses seek scalable learning solutions to traIn their employees in today's dynamic business environment. This trend is driven by the increasing use of smartphones and other mobile devices for professional purposes, enabling employees to access learning materials anytime, anywhere. Cloud-based learning platforms have emerged as a popular choice for delivering m-learning content due to their flexibility and ease of use. These platforms allow organizations to customize content to meet the unique needs of their workforces, ensuring consistent training experiences across the organization. Artificial intelligence (AI) and machine learning (ML) technologies are increasingly being integrated into m-learning solutions to provide personalized learning experiences.

These technologies enable platforms to analyze user data and tailor content to individual learning styles and preferences, leading to increased engagement and better learning outcomes. M-learning is not limited to specific industries, but rather is being adopted across various sectors such as healthcare, IT, finance, and manufacturing. Geographical trends indicate that the demand for m-learning is highest in regions with high internet penetration and a large remote workforce. The customization of content is a key factor In the success of m-learning solutions. Virtual and augmented reality technologies, adaptive learning technologies, and gamification are some of the engaging content formats being used to enhance the learning experience.

The globalization of businesses and the rise of telecommuting have led to an increased demand for digital training solutions. Traditional in-person training methods come with significant expenses related to travel, accommodation, and venue rental. In contrast, m-learning solutions offer cost savings and increased efficiency. M-learning solutions are not limited to mobile devices, but also include laptops and tablets. High-speed mobile internet and touchscreens have made it possible to deliver interactive multimedia presentations, video lectures, and interactive assessments, making learning more engaging and effective. Security and connectivity are critical considerations for m-learning solutions. Mobile content authoring tools and software solutions enable organizations to create and deliver content securely and efficiently.

M-learning solutions offer a range of benefits, including increased job satisfaction, improved retention rates, and reduced turnover rates. They also offer flexible learning options, allowing employees to learn at their own pace and on their own schedule. Microlearning and bite-sized content are becoming increasingly popular in m-learning solutions. These formats enable employees to learn in short, focused sessions, making learning more accessible and convenient. Collaborative learning platforms and online communities, such as forums and group projects, are also being used to enhance the learning experience. These platforms enable employees to learn from each other and build a sense of community, leading to increased engagement and better learning outcomes.

The future of m-learning is exciting, with the integration of 5G technology and the metaverse offering new possibilities for immersive and interactive learning experiences. Ed-tech firms and online schools are also exploring the use of 3D creative platforms, coding, and interactive learning to provide more engaging and effective learning experiences. In conclusion, the market is experiencing significant growth as businesses seek scalable and cost-effective solutions for training their employees. The use of smartphones and other mobile devices, cloud-based learning platforms, and AI and ML technologies are driving innovation In the m-learning space. The trend towards flexible and personalized learning experiences is expected to continue, with collaborative learning platforms, microlearning, and immersive technologies offering new possibilities for engaging and effective learning experiences.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 24.68% |

|

Market growth 2024-2028 |

USD 62.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

19.55 |

|

Key countries |

US, India, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Corporate M-Learning Market Research and Growth Report?

- CAGR of the Corporate M-Learning industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the corporate m-learning market growth of industry companies

We can help! Our analysts can customize this corporate m-learning market research report to meet your requirements.